SECTION 3: WHAT DRIVES REAL ESTATE PRICES IN PHUKET AND HOW TO ASCERTAIN VALUE

Phuket Real Estate Pricing

It is almost a misnomer to refer to “The Phuket Property Market” because it is not a homogeneous entity. It is divided (and even subdivided) into categories which collectively include a diverse array of buyers. This section aims to address some of the fundamentals which impact the cost of property in Phuket, with an emphasis on the prices being paid by foreigners.

Although property values in Phuket have been rising over the last few decades, they still remain extremely competitive when compared to other similar global tourist destinations. Foreigners who visit the island and who later become prospective property buyers, are usually pleased with what they can get for their money, based on their own personal perceptions of value. This is especially true for foreigners from the west, whose home countries have experienced rapid real estate price growth, in many cases far outpacing Phuket’s tamer real estate market.

How Much Different is the Phuket Property Market to the Rest of Thailand’s?

It is worth spending some time distinguishing the differences between the Phuket property market, and the market in Thailand as a whole (or even in Bangkok specifically).

Bangkok is the capital city of Thailand, and also the major population centre for the country. With a total population of over 16 million, Greater Bangkok is home to nearly one quarter of the total population of Thailand. And because there are more people concentrated there than anywhere else in the country, the property market tends to move with the economy.

In a strong economy, like we have seen for the last decade, estimates of demand for condos and houses in the capital can become optimistic, and over-building can, and does, occur. Periodically, we will hear stories and reports of unsold condominium units in Bangkok, as we have for years. But that is Bangkok, not Phuket. Phuket has its own type of economy, and correlates more with the tourism sector, than the country’s economy as a whole.

It is also worth noting that due to supply and demand dynamics, its rapidly growing population, and the limited amount of land on the island, Phuket property prices in specific high demand areas close to west coast beaches, have likely outperformed the broad market price increases seen throughout the rest of the Kingdom. This is especially so during the post-Covid era, when demand has been considerably higher than in the decades leading up to current times.

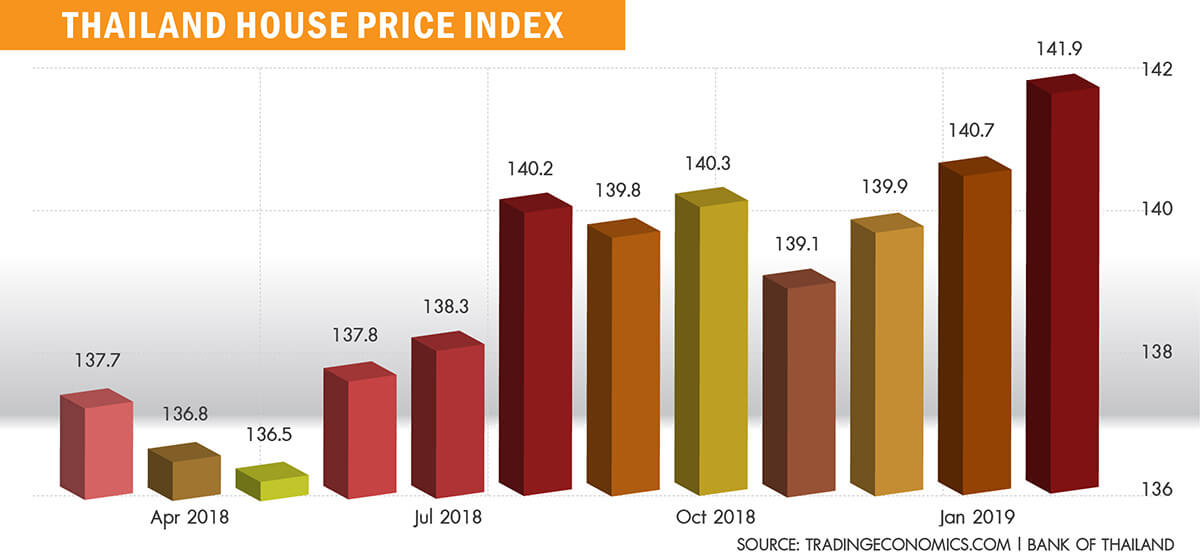

THAILAND’S HOUSE PRICE INDEX

How Tourism Drives the Real Estate Sector in Phuket

For the past few decades, Phuket has seen consistent year on year growth in the number of tourists visiting the island. Nearly one third of all tourists arriving in Thailand will visit Phuket during their stay. In 2019, Thailand received around 38 million tourists, and, therefore, just under 13 million of those stepped foot on to the sandy beaches of Phuket. After the inevitable slow down during Covid, those numbers are steadily creeping back to those 2019 historic highs.

We have written extensively over the years just how intrinsically connected the real estate sector in Phuket is to the tourism industry. Essentially, they are joined at the hip. The Phuket real estate industry could obviously not survive without tourism. As a foreign driven market, Phuket needs new visitors every year to create new buyers for so many of the new investment and residential projects currently under construction.

Phuket property prices may loosely ebb and flow with the rest of Thailand, but the key factor predominantly driving the real estate sector in Phuket is, and has always been, tourism. This is what sets its real estate sector apart from the country as a whole, mainly because tourism and its related industries, by far make up the largest part of Phuket’s economy.

Nearly every foreign buyer of Phuket property is introduced to the island by first taking a holiday here. Everything tells us tourism in Phuket will continue to grow and, with it, the real estate sector will continue to flourish too.

The evolution from visitor to resident sometimes takes a while, but it happens a lot. People fall in love with Phuket, and it gradually becomes their default vacation destination, with more and more holidays being spent here. The love affair with the island is truly complete when they buy a condo or villa in Phuket, and later decide to move, work or retire here.

During the pandemic, however, scores of people “skipped a few steps” and made Phuket their lockdown home of choice. Or, after the pandemic, revalued their lifestyle choices after being locked down in a cold wet city, opting instead for a warm sunny tropical island should the same situation every come around again.

Phuket’s investment condominium market saw especially rapid growth over the last 15 years, and this was due in large part to the increase in tourism. However, after the pandemic, due mainly to the influx of new foreign residents, the focus switched to family homes, and the largest increase in demand was for residential villas, rather than investment condos.

How Do Interest Rates Impact Real Estate in Phuket?

In short, they do not. Whilst Thai nationals in Bangkok may purchase their own homes (over 70% of Thais own their own property), most new buyers will have to borrow to make their purchase. Interest rates, therefore, have a far greater effect on the property sector in the capital than they do on Phuket property, where the vast majority of deals done are cash purchases.

Interest rates do, however, effect the mindset of anyone considering a Phuket “investment” property purchase. For example, in the wake of the global financial crisis in 2008, interest rates were lowered to encourage spending and investment, and to discourage savings. The relatively meagre income being offered by traditional investments (e.g. bonds, fixed deposit) prompted investors to look elsewhere for higher returns. Some countries, primarily in Europe, experienced negative interest rates, meaning banks were actually charging depositors for the privilege of holding their money.

These “negative interest rate” policies motivated investors to look for alternative sources of income, and the idea of an income producing rental property on a tropical island was naturally quite appealing. This led to a marked increase in studio and one bedroom units being sold to foreigners, who could rent them out for better yields than a bank could offer.

Today, in 2024, that situation has changed. Inflationary pressures around the world and the US Federal Reserve subsequently raising rates, has forced other central banks to also raise rates. Interest rates started increasing in 2020, and central bankers now seem determined to keep us at what was once considered normal, namely interest rates of 5% – 6%.

Higher rates generally slow the pace of property purchases in other parts of the world, as well as possibly lowering house prices. In Phuket, however, because it is almost impossible for a foreigner to get a mortgage, virtually all property sales are done for cash. No cheap borrowing means no over-speculation in Phuket property. No speculation means no Phuket bubble. No bubble means no crazy Phuket price spikes. Likewise, the interest rate increases over the last 4 years have not sent prices lower because foreigners do not rely on borrowing to buy Phuket property.

Prices in Phuket’s foreign driven market have gradually increased, but it has been a steady rise, predominantly buoyed by the natural forces of inflation and demand. Historically, neither lower or higher interest rates have had a noticeable impact on the property market on the island.

However, the real estate market in Phuket was almost non existent during the previous high interest rate environment in the early 1980’s, so we have no historical precedent on how that would now affect Phuket’s current mature market, should interest rates return to those historic highs.

Back in the 1980’s, interest rates peaked at 18%, but this was long before Phuket was on the international radar. It cannot be ruled out that at some stage in the future, interest rates could go way higher than they are today. There is no way in telling what this would do to the Phuket real estate market, but it is unlikely to be favourable. It would be especially detrimental, should interest rates get back to the levels of the 1980’s, or beyond.

If interest rates should rise to much higher levels, the returns from Phuket investment properties will also likely seem less appealing, should investors be able to achieve solid returns from bank deposits and other forms of fixed income.

It is also worth adding that any significant slowdown in the global economy, due to inflationary pressure and subsequent higher interest rates/borrowing costs, will also affect property sales in Phuket. Less disposable income for people worldwide, means less money to spend on holidays. Less tourists arriving in Phuket, means less buyers of Phuket property. And as we have already stated, the real estate market in Phuket relies heavily on a constant influx of new tourists to keep the market propelling forward.

Phuket Real Estate Market Inflation

Phuket property prices have always been more correlated to its booming tourism industry than to any other factors, which includes interest rate policies, whether they be local Thai policy, or the those of other countries around the world.

Nevertheless, inflationary pressures do persist in Phuket, too. This is unavoidable during economic periods of excess money creation. It is a fact that a sizable amount of this “new money” also finds its way to Phuket. This may be via tourists, new incoming residents, affluent Thais in the capital, and also investors. This fresh incoming money, therefore, has an obvious effect on local inflation and therefore it also has an effect on the Phuket real estate market. More money arriving onto the shores of Phuket, means prices are forced to rise, because there is more money chasing the same amount of goods and/or services.

For the development of new property in Phuket, we can define “goods” as the raw materials needed to construct a property. And we can define the “services” as the cost of lawyers, architects and all other labour costs involved throughout the construction process. It is, therefore, impossible for Phuket to escape everyday inflationary pressures. This includes the cost to buy or do anything, including the planning, marketing and the construction new villas or condominiums.

Modest inflation is the target of almost every central bank, and most consider a “healthy” rate of inflation to be between 2% and 3% per annum. But as the world emerged from the pandemic, it experienced inflation not seen (at least in the west) in over a generation. Supply chain interruption, increased energy costs, unexpected shifts in demand, and higher raw material and wage costs, have led to higher than average price increases on nearly all property in Phuket over the past 24 months.

As the costs to produce any product increase via inflation, the value of any final product will always be a higher number. Inflation pushes up the building costs of every property in Phuket. Bricks, mortar, roof tiles, household appliances, the fixtures and fittings – even the plants for the garden – have all been increasing in price. No developer has been able to escape the effects of this, whether their focus is on the Phuket condominium market or the Phuket villa sector.

Unlike conventional leveraged markets, Phuket has always managed to avoid the volatile peaks and troughs associated with property booms and busts. Historically, prices on the island have edged up 4%-5% per annum, but the post-Covid era has seen prices increase on some projects by 20%, 25% or even 30% in a single year.

Unfortunately, Phuket does not have its own housing index, but we can gain some understanding of Thailand’s broad property market from numbers released by the Bank of Thailand. In the years in which Thailand experiences an all-round boom nationwide or in the capital, this does tend to create an uplift on Phuket property prices too.

The national statistics suggest that while the broad Thai property market has experienced intermittent slowdowns over the past 15 years, its trend has been that of steady gains every year, right up until the 2020 pandemic – not once ending a year lower than it began.

In June of 2024, the broad Thailand Housing Index, reached an all time high of 161.80. Since 2011, the index is up over 60% and has also accelerated since the pandemic, up nearly 30% since the beginning of 2020.

One segment of the Phuket property sector that has been noticeably outpacing average inflation, is the rental market. The cost to rent a well positioned villa or luxury condo on the island, whether for a short term rental or longer term contract, does appear to be a little out of whack. Prices for many new arrivals looking for a rental property, are often astounded at the rental rates being demanded by owners.

During the pandemic, fewer villas and condos were being built as Covid kept building sites largely empty, so we experienced an inevitable drop in supply. Combined with the increased demand for accommodation on the island from new residents moving in, owners have been able to command far higher rental rates than they could have done in previous years. This has been especially noticeable with rental rates on luxury pool villas, which at present, do appear to be somewhat unrealistic. This may be addressed in the coming 12 months as more and more new villas come on to the rental market.

Land Scarcity in Phuket

Land scarcity (Phuket is an island, after all) almost certainly has a massive impact on property prices in Phuket, although this applies mostly to high demand land on or close to the west coast of the island. This is where the Andaman Sea is aquamarine blue and crystal clear for 6 to 7 months each year. Most of this land has already been developed, but what remains carries a much higher price tag today than it did just a few short years ago.

There is still a great deal of land available for sale on the eastern side of the island, and the unaffordability of land, for both private and commercial purposes, on the west coast, has created some new “up and coming” areas. Cape Panwa, Cape Yamu and some areas of the north east are just a few examples, all of which have been transformed over the last 5 years. The east coast views over Phang Nga Bay are what attracts buyers, and the isolation of these areas may be more appealing to some people than the bustling tourist areas of the west coast.

With the scarcity of land and the increase in tourism, onlookers may even believe that Phuket property prices should be increasing faster than they have, but there are some key factors worth noting that help to keep rising villa and condo prices in check: Burmese labourers and the Supply-Demand dynamic.

Phuket Wages and Wage Inflation

Just as neighbouring Malaysia employs a vast amount of Indonesian workers, Thailand also shares a similar dynamic with Myanmar. Myanmar’s workforce has been crossing the border for decades, and many get attracted to the tropical island of Phuket.

Most construction in Phuket (in fact, throughout Thailand) utilises Burmese workers. There is an ample flow of new willing participants, and given the employment prospects at home, they are happy to accept work in Thailand. They are also willing to work for lower wages than a local Phuket national would demand. This obviously plays a huge role in the costs of constructing any type of building in Phuket.

That said, in any economy, wage inflation affects everyone, including foreign workers, both legal and illegal, so wages have also increased in line with general inflation rates for the Burmese workers in Phuket too.

The Supply and Demand Dynamics For Phuket Property

Conventional supply-demand dynamics have never really applied to the property sector in Phuket.

In classic scenarios, when a large number of buyers are looking for properties, but no one is selling, it creates a fast-paced market with prices rising and new developments and/or resales selling out quickly. When the tables turn, and the market is flooded with properties, owners begin to find it harder to sell as prices start to fall. A buyer looking for a great deal usually finds one during these periods.

One of the reasons this cycle repeats itself over time is that periods of weak demand result in fewer properties being built, and the resulting scarcity drives prices higher when demand improves. The “boom times,” however, typically see over development, which leads to oversupply, weakening demand and falling prices.

The Phuket property “foreign buyer” dynamic has so far prevented this “boom-bust” scenario from playing out here, mainly down to the lack of borrowing facilities in Phuket for foreigners. Visitors to the island come from all over the world, but the specific nationality of the largest tourist segment, and thus the property buying segment, keeps changing as individuals from different countries discover the island. Typically, when demand falls from one nationality, it is replaced by another nationality, which takes up the slack.

The buyers of Phuket real estate once came almost exclusively from Europe and America, as well as Thailand’s Asian neighbours (e.g. Hong Kong, Malaysia, Singapore, Australia, New Zealand). But when certain currencies significantly weaken, we tend to see less of that country’s nationals coming to Phuket. After Russian holiday makers discovered Phuket, we saw a large number of sales taking place to Russians and other Eastern Bloc countries. Russian activity then lessened as the result of a depreciating Ruble, which is when the Chinese stepped in after discovering Thailand. And currently, since the troubles in the Ukraine have escalated, the Russians have returned and are once again a major influencer on the growth of the Phuket property market.

Throughout the last three decades, apart from the short window just after Covid, there has not been a protracted decline in demand for Phuket property long enough to send prices significantly lower (as some volatile western markets have experienced), nor has there ever been huge over development due to excessive estimates of future demand. Instead, supply has simply kept pace with demand, and buyers have been willing to accept modest price increases for new units.

The last 18 months, some may argue, has been an anomaly, with a greater rise in prices than historical comparisons. This has been mainly due to the large increase in foreigners moving to the island and subsequently looking for a new villa to raise their families in. This recent increase in demand and popularity of Phuket has also allowed some developers to demand higher prices than in periods of lower demand.

Obviously, some of these increases have been due to the natural forces of inflation, but this period of higher than average demand has also forced land values higher, pushing up the prices of new Phuket villas, as well as some new condos offered by developers.

Economists have a measurement of how much demand changes as a result of price increases, which they call “price elasticity of demand”. Inelastic consumer goods include tobacco, alcohol, and medicine because any price increase has very little impact on demand.

Phuket real estate is neither an addiction nor a life saving medication, but it is what economists would call “relatively inelastic”. As long as the inflow of new tourists and residents continues to keep pace with the supply of new Phuket real estate projects being launched, there is no reason for this to change.

Is Phuket Property Still Considered Affordable in 2024?

There is no doubt that prices have risen well beyond the average historical price growth in the last 2 years. So, do new potential buyers arriving on Phuket still consider Phuket property great value?

As mentioned earlier in this guide, the Phuket real estate market is not a homogenous entity. There exists a diverse range of property types, covering many areas of the island. Buyers of property also come from a broad range of countries, each one with their own perception of value, depending on the experiences they’ve had with the real estate market in the country they originated from. Affordability and value for money, therefore, might be somewhat subjective when scrutinizing Phuket property prices, as “affordable” means different things to different people.

Affordability in Phuket’s foreign market is thus down to who has cash and who doesn’t, and as long as the prices in Phuket remain low relative to the countries where the buyer has worked and lived, Phuket will remain an attractive place to buy.

And with house prices in the UK, the rest of Europe, Australia, North America and even China and Russia, all significantly higher than the cost of most equivalent properties found in Phuket, the prospects for a buoyant market going forward are quite favourable.

Salaries in Phuket do not really have an effect on affordability either, as many foreign owners do not even live in Phuket. Given the number of foreign buyers who earn their living elsewhere – outside of Phuket, and not necessarily even in Thailand – the traditional relationship between house prices and salaries/wages does not directly impact the foreign market. And with foreigners generally unable to finance a Phuket property, the prices are also not affected by local interest rates, nor are they subject to the “boom and bust” scenarios which can result from excess lending.

As already mentioned, one factor which could affect foreign demand in Thailand are the deposit rates being paid in other countries. Many foreign buyers in Phuket are seeking rental returns to compensate for the interest rates currently being paid by banks. If deposit rates begin to rise again, prospective buyers would have to determine whether a Phuket property investment is generating a decent enough return to justify tying up their cash.

Phuket’s Local Market

It is impossible to discuss a property market as dynamic as Phuket’s without a discussion of the local market. While much of the “visible” real estate market on the West Coast targets foreigners, there is a sizeable (and growing) local population in Phuket, and they are also buying.

While the median household wage in Thailand may still be low by western standards, the influx of Burmese workers for low-wage, labour-intensive jobs is a solid indicator of the growing prosperity among Thai households.

A strong economy has created a rising tide in wealth, which has (so to speak) lifted all boats, and the net-worth of most Thai nationals in Phuket continues to climb. That said, most local salaries are not high enough to afford those property developments targeted at foreigners, but there are plenty of areas on the island where housing is affordable to someone on a local wage.

For the local population, the traditional ratio of house prices to wages does determine affordability, and any change in this ratio will affect the demand within the local market. But if the price gap between local developments and those targeting foreign buyers becomes too wide, there could be a knock-on effect for “foreign property prices”.

In this way, local prices can act as a quasi-cap on foreign prices.

How Confidence and Optimism Affects Phuket Property

As we have reiterated throughout this Property Guide, Phuket’s real estate market varies considerably from most other markets around the world. Conventional markets may be affected by interest rates, inflation, affordability, ease of borrowing, as well as supply/demand dynamics. But they are also affected by the current market confidence and enthusiasm.

In any property market, confidence is directly correlated to the number of new buyers: the more buyers, the higher the confidence. So, what typically drives confidence in Phuket?

As we know, the tourism industry makes up a very large percentage of the local economy. In times when the tourism industry is booming, the real estate industry is up there keeping pace. It can be said, therefore, that local business confidence really refers to how well or poorly any particular year is for the hospitality industry and the other industries that rely heavily on tourists to generate income.

The performance of the tourism industry creates a ripple effect in both the local market and the foreign real estate market. When tourist industry activity levels drop, the foreign market always suffers, and we certainly see less buyers of real estate. But the same applies for the local Thai market, but with slightly different dynamics. When tourism slows, most hotels and tourism related businesses cut costs, fire staff, and even put any expansion plans on the back burner. This obviously has a major effect on employment, affecting the local market. If an individual is worried about their job, or the economy in general, they are likely to hold off on buying a property.

Because Phuket is a tropical island and because, for the most part, it is always thriving, there doesn’t ever seem to be a lack of confidence in Phuket. We can name a few times the island has come to standstill in the past, but these were relatively short periods of time, and things hurried back to normal.

At time of writing, the outlook for Phuket property still remains positive. Tourist numbers are increasing year on year, buyers confidence remains high and real estate professionals on the island, as well as developers, remain optimistic.

In Summary

The Thai and Foreign property markets in Phuket are distinct, but the fortunes of both are inextricably tied to the island’s tourism sector.

As the island continues to develop and prosper, so too will the property sector. Phuket is an island, so land is definitely finite. Eventually (who knows when this will be) there will be no more land available for development. Scarcity and inflation are playing a role in rising prices at the moment, but longer term these are still likely to be the “double-whammy” which should support higher prices on the island for years to come.

Phuket Real Estate Market Articles

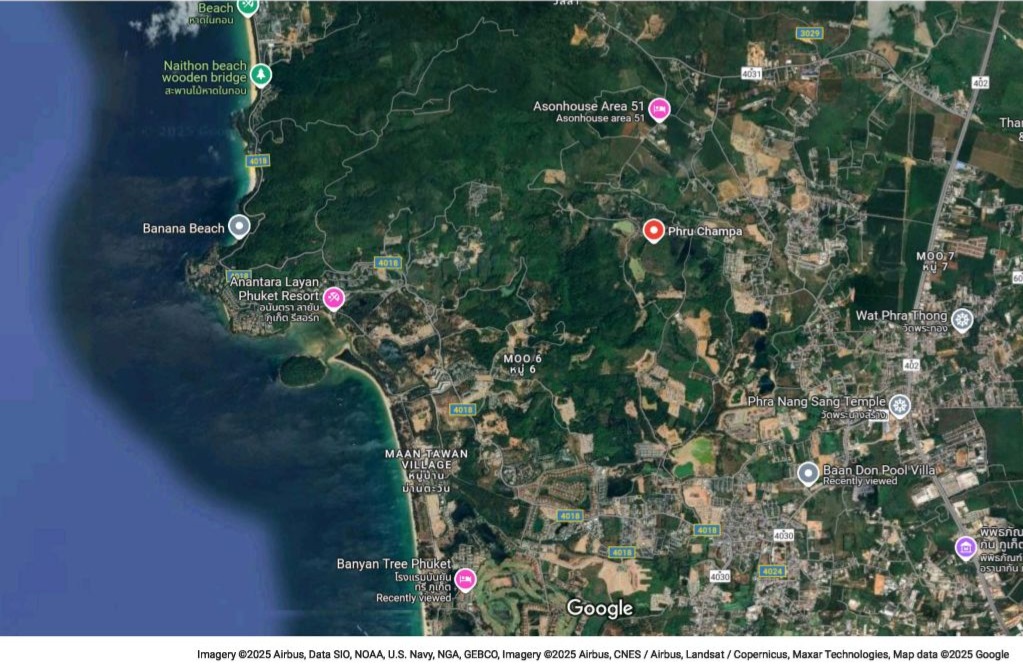

Pru Jampa – Phuket’s Next Residential Hotspot

Pru Jampa is quickly becoming one of Phuket’s most desirable addresses, thanks to a growing collection of luxury villa projects that blend contemporary design with natural serenity. Surrounded by lush greenery yet just minutes from beaches, international schools, and lifestyle hubs, the area is home to some of the island’s most exciting new developments. From award-winning builders like Botanica, Erawana, and Anchan, each project offers privacy, quality, and strong investment potential — making Phu Champa the smart choice for buyers seeking peace without compromise.

Erawana Creek – Tropical Serenity in the Heart of Pru Jampa, Phuket

Erawana Creek - Boutique Tropical Pool Villas in Pru Jampa. Discover the tranquility of Pru Jampa at Erawana Creek, a beautifully designed enclave of private pool villas by the respected Erawana Group. Each villa blends modern tropical architecture with seamless indoor‑outdoor living, featuring natural light, spacious terraces, and lush garden surrounds. Located minutes from Bang Tao and Layan beaches, and just a short drive to lifestyle hubs like Boat Avenue, this intimate development offers serenity without sacrificing convenience, an ideal choice for discerning buyers seeking privacy, quality, and a rare sense of retreat in Phuket.

SECTION 3: What Drives Real Estate Prices in Phuket and How to Ascertain Value

Real estate prices for both villas and condominiums in Phuket is governed by land values, labour costs and raw material costs. All of these have risen significantly over the past few years, but land values have been the driving force in the rise of property values over the last 3-4 years. This section aims to educate buyers on what drives prices in Phuket, both historically, presently, and moving forward. With a better understanding of the Phuket property market, buyers will be able to make discerning and educated decisions, before they purchase.

SECTION 4 : Valuing a Phuket Property

It is a known fact in the Phuket real estate industry that the true tangible price of a property is based solely on the final agreement made on price, between both the buyer and the seller. Of course, some buyers overpay for a property and have trouble selling again later. But the attraction and value of any singular property in Phuket is subjective, and beauty is in the eye of the beholder. A seller believes their property is worth a specific price, but the reality is that they will only achieve that asking price if one of the multitude of buyers agrees that the offer price is acceptable. If a property stays on the market for years, then the property is likely extremely overvalued.

SECTION 5: The Different Types of Phuket Property

There are many different types of Phuket property, with an array of different legal structures. This section assists to identify the different types of Phuket property for sale in Phuket. Although the various types are easy to define, sometimes these categorisations may overlap, creating even further sub-categories. If anyone is a serious buyer, it pays to understand the various types of properties that may be on offer in Phuket and to understand the legal connotations explained in later sections.

SECTION 6: The Inherent Risks to Buyers a Buyer Should be aware of – What Every Buyer of Property in Phuket Needs to Know

Foreigners who arrive in the “Land of smiles”, are mesmerised by how beautiful the Kingdom of Thailand is, and that surely in such an incredible place, full of such nice people, nothing can go wrong. Unfortunately, things often go wrong in Phuket, through either unfortunate circumstances, deliberate intentions or through the bereavement of the original lessee or land owner who made promises that the heirs refuse to accept. Buyers also need to be aware that many properties in Phuket are built illegally, and so the sale of the property at a later date, sometimes proves impossible.

Social Contact