SECTION 17: PHUKET’S NEGATIVES – TAKING OFF THE ROSE COLOURED SPECTACLES

How Rising Interest Rates May Be a Negative for the Phuket Real Estate Market in 2024/5

Interest rates have not, historically, had the same influence on the Phuket property sector as they have in other highly leveraged countries with huge and freely available borrowing. In many western markets, where the increased cost of borrowing could make a mortgage unaffordable, there have often been wild cycles and/or boom-bust scenarios.

However, if global interest rates keep rising they could reach levels that make deposit savings far more attractive than a Phuket property.

Until very recently, most global interest rates were held atypically low for nearly 10 years, but when the US raised the Fed Funds rate, the rest of the world followed suit. This caught many financial institutions off guard. Thus, during 2023, some banks fell into bankruptcy.

In addition to further rate hikes causing a future potential banking crisis, rising rates have throughout history been a precursor to stock market crashes, which further stunts global investment.

Higher interest rates are also a remedy to combat higher inflation, and a higher cost of living means spenders have less spare cash, less money for holidays, which is further exacerbated by higher flight and hotel costs the world over.

Can Our Crazy World Affect the Phuket Property Market?

Phuket real estate has always been somewhat isolated from the rest of the world, however, events over the last few years have certainly made us re-examine the potential threats we may face from both looming geopolitical and economic surprises. Here we address what may possibly go wrong for the Phuket real estate sector.

Geopolitical Concerns – How Intergovernmental Policies Affect Phuket Property

There will always be short, medium and long-term risks for the Phuket real estate market. Phuket has historically been relatively detached from the rest of the world, however international geopolitics undoubtedly play a role in global financial stability and instability, even here on a far flung tropical island.

Diplomatic relations are not normally a risk for Thailand, as the Kingdom very rarely falls out with other nations. But other governments economic policies can and do affect Phuket tourism. And it has been shown that the tourism market and the Phuket real estate sector are inextricably linked. For example, foreign governments making it easier or harder for their citizens to travel abroad, such as we have seen in recent years with both China and Russia, did influence tourist numbers over these periods.

Wars also have a noticeable effect on Phuket real estate, but sometimes the results can be positive. We have seen many Russians and Ukrainians, not just visiting Phuket during the current conflict between these two nations, but also deciding to stay and live on the island, subsequently buying real estate.

At the time of writing, we do not yet know the ramifications on how the Israel/Palestine conflict may affect Phuket, or the rest of the world.

Unprecedented Global Debt and the US Dollar and How it May Affect Phuket Real Estate

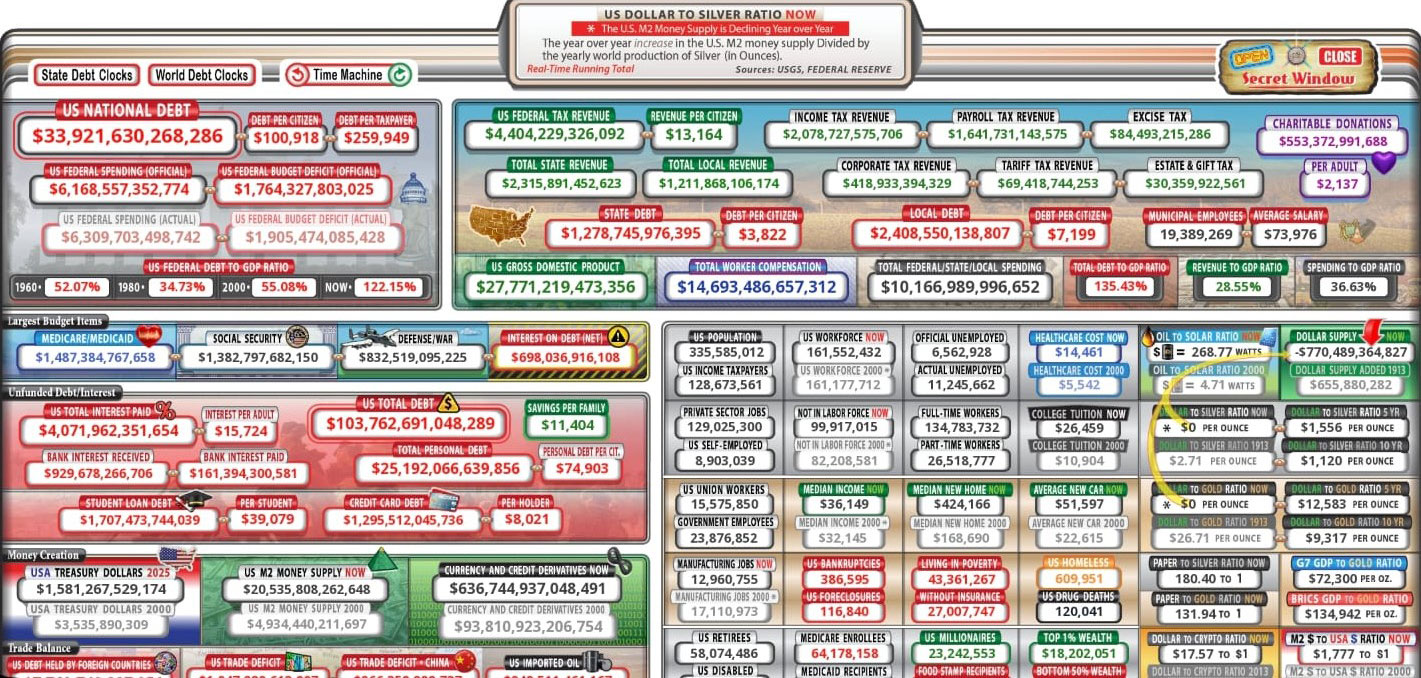

It is hard to describe the huge levels of debt in the world as anything less than a house of cards. In the IMF’s 2023 Global Debt Monitor the total amount of global debt, which includes public and private debt, sat at US$235 Trillion. This is expected to be significantly higher when the new numbers are released for 2024.

We most certainly have to keep an eye on the seriousness of these unsustainable debt levels and how, at some stage in the future, a debt implosion could wreak havoc, not just on the Phuket real estate sector, but all markets across the globe.

At time of writing, on October 10th, 2024, the US National Debt has edged past the US$35 Trillion mark. This unfathomable figure is still growing and is now sitting at over 122% of US GDP. But it is not just the US that has been borrowing insanely, many countries have taken the same precarious path. Japan, for example, has over 263% of debt as a percentage of GDP. Even Thailand has surpassed the debt levels seen during the Asian crisis, 25 years ago.

When exactly will this global debt bubble burst? Nobody knows, but one thing is for certain: unless governments reign in their spending, there can be no happy ending to this financial drama, not for the world, nor for Phuket property.

The BRICS Nations and How Their Objectives May Change the Phuket Real Estate Sector

It is never easy to predict what disasters may be lurking in the shadows, but a new global financial crisis will undoubtedly have a detrimental effect on Phuket’s real estate market.

The aforementioned global debt problem may be exacerbated by the BRICS nations forming a coalition to challenge USD supremacy. If more countries continue to join BRICS, we may see some of the biggest changes to the global financial landscape for 50, or even 100 years.

Described by some as an economic wrecking ball, this new proposed global currency seems to be taking off, attracting new countries to join every month. If this new currency is introduced into the global financial system in earnest, we will see a weakening of the USD, which will mean policy makers in the US and other nations will be forced to move interest rates even higher, making the servicing of all existing debt even more difficult to maintain. This will, of course, be further exacerbated by the inevitable demise of the Petro Dollar, which is also on the cards.

Could We See Declining Tourism in Phuket?

Because they are interconnected, both the foreign and local markets could be impacted by a few consecutive poor years in the tourism sector.

We know that tourism is a key driver of the Phuket property sector. Falling tourist numbers would therefore mean fewer buyers for many of the developments on the island. In addition, declining tourism is all that it would take to reduce local employment and salaries. If this were to happen, there would be an almost immediate impact on both local and foreign market property prices in Phuket.

Phuket Housing Affordability

As mentioned previously, this is a major factor affecting the growth of the Phuket property market. If prices remain too high for too long (relative to wages) the real estate market can struggle, and one potential impact on Phuket property affordability would be a shift in global interest rate policy.

We already know that low interest rates can buoy investments into tangible assets like property, and that this can also be a mixed blessing in times of a softening real estate sector. People grow accustomed to low rates, even unnaturally low ones, and a hike in rates in either Thailand or in the west could derail the housing market.

The foreign property market in Phuket is somewhat isolated from other markets around the world, however, prices have risen far more over the past 3 years than they have in most people’s memory. If they continue to rise at the same pace, Phuket property, both in the foreign and the local market, may become unaffordable for the vast majority of would-be buyers.

Despite the recent volatility in emerging markets Thailand has been spared any major turmoil thanks in large part to its current account surplus and sizeable foreign reserves. But if Thailand reacts to a global upward shift in interest rate policy with further rate hikes of its own, then it is possible an economic slowdown could follow.

If that were to happen, it could lead to a slowdown in the local property market, not just in Phuket, but in Thailand as a whole.

Change in Government Policy

Any changes in Thai government policy directly related to the property market will inevitably have an effect on prices in the local market (either positive or negative, depending on the policy).

One example in a normal economy is when a government changes the loan-to-value ratio to tighten mortgage lending requirements. In a heavily leveraged market, this is bound to have a knock-on effect on property prices, and may even result in a greater volume of unsold properties.

Luckily this policy does not really affect the cash only Phuket property market, however, there are many changes in rules, laws and policies that do have an effect, whether they may be federal or local. These are sometimes positive, but when it involves landed property ownership, they are more likely to be negative.

There are a number of issues worth keeping an eye on that may be either positive or negative for Phuket real estate. The new taxation on foreign residents spending more than 180 days in Phuket seems likely to come into being (negative). New zoning or environmental regulations may change the market landscape (can be negative or positive). Stricter adherence to the laws at the Land Department to thwart Thai Company ownership (historically negative). Changes in rental laws, or the stricter enforcement of current laws, can make it harder and/or not as profitable for owners to rent their villa or condo (negative).

Obviously we welcome the policies that are positive for the real estate industry in Phuket. Unfortunately, this isn’t always the case, and we are always prepared for surprises.

Thailand’s Household Debt

The low interest rate environment has also led to an increase in Thailand’s household debt levels. Thailand currently has the 27th highest GDP in the world, with the 14th largest household debt to GDP ratio.

It is nice to see Thailand prospering, and if household debt levels stay as they are (all else being equal) there should not be too much cause for concern.

However, if there is serious expansion of personal debt, or a spike in the interest rates payable on that debt, unchecked levels of household borrowing could be a major worry for the Thai economy. This could be one of the components that may lead to a weaker Thai Baht.

A Crackdown on Thai Companies Used to Buy Property

We also have another obstacle to overcome in Phuket. Thai law has been loosely enforced over the past 30 years, but it does appear that the authorities are once again taking a number of different issues seriously which will affect foreigners. Many foreigners are avoiding taxes, using nominee shareholders and running non-trading/non-compliant Thai companies and this may once again become a major issue at some stage in the future.

Foreigners buy houses and villas every day using Thai companies with nominee shareholders. If the authorities at some stage decide to toughen their stance on what constitutes “illegal ownership”, it would certainly impact the real estate sector. This has already affected the Russian market, with many Russian nationals now favouring leaseholds over freeholds when purchasing a villa.

If illegal holding vehicles are scrutinized in earnest, the end result could be a flood of villas and landed properties on the market, which would likely cause prices to stagnate or even fall. If this comes to pass, demand is likely to be softened by the negative publicity alone, which would also have a knock-on effect on prices.

Global Crises and Their Influences On Phuket

Certain external events are foreseeable (or perhaps, inevitable), and can have an oversized impact on Phuket’s tourism industry, especially when you consider that their origins may not necessarily be in Thailand, or for that matter in Asia. Even a healthy economy can be affected by “contagion” during global crises and meltdowns.

Consider a global stock market crash, and the recession which would follow. It is highly unlikely to be the Thai markets which lead to any such collapse today, but Thailand would feel the effects. A drop off in global spending would mean fewer people traveling to Thailand, and fewer Phuket properties being bought.

The reaction of Central Bankers to an economic downturn would typically be to lower interest rates, which could lead to a quick rebound in the property sector. But the initial downturns in tourism and property would be unavoidable.

Are We Seeing an Over Supply of Phuket Property in 2024?

In every real estate market in the world prices begin to stagnate and even fall when supply outweighs demand. This is something we have not really experienced in Phuket. Historically, there has always been “market equilibrium” with the number of new villas and condos being built in Phuket being easily absorbed by the consistent demand from new buyers.

However, things have changed since the island opened up again after Covid. The real estate boom we have experienced since then has been unprecedented, and villas, condos and land values are significantly higher now than what they were in 2020, driven up mostly by a huge increase in demand.

Developers have swooped on this opportunity and we have seen more new projects being launched in the last three years than in any three years throughout Phuket’s history. Some estimates put the number of new units (a combination of villas and condos), as high as 100,000, all of which will be completed within the next 2 years.

New Phuket property buyers should, therefore, be aware of the supply-demand dynamic within the Phuket real estate sector. With so many new developments springing up over the last few years, the resale market could also potentially have a massive ‘overhang’. Buyers must have a long-term approach if they are to take advantage of the supply-demand dynamics, and although things may soften in the short term, those with a longer term view will likely be rewarded.

Negative Publicity of the Phuket Property Market

Bad publicity is detrimental to any industry, and the real estate sector in Phuket has not been immune to this. We have heard of many individuals or companies engaging in either unethical or illegal activities, which is why it is so important to conduct thorough due diligence when buying a property.

Some complaints have found their way into the newspapers and online media, and have stoked negative publicity.

Examples include:

During the boom years of investment condos leading up to 2019, another troubling sales tactic came to light. Foreigners were literally being told they can wind up with one or more free properties if they buy a number of units off-plan.

Some agents were encouraging foreigners to buy multiple condominiums, with the promise that the agent will, upon completion, personally broker the sale of enough units to either break even or turn a profit. The sale will allegedly leave the foreign investor with at least 1, and possibly many “free” condominiums.

We don’t necessarily want to call this practice a lie, so let us just say it is a non-contractual promise which is highly unlikely ever to be realised. In a worst case scenario, the investor owns a slew of condos, and has paid for all of them. However, if they are committing too much of their savings or their nest egg to this strategy, it could leave the investor strapped for cash should the “highly profitable sale” (on which this whole marketing scheme is based) never materialise. Any buyer should see through this for what it is – a sales tactic designed to enrich one person.

Thankfully, we do not hear of this type of sales tactic anymore, but buyers should still be careful about what they are told by agents. Many foreigners have lost a lot of money because they did not understand what may go wrong, and many may not even have sought legal advice.

The Phuket property market does not need any more negative publicity, but if there are further issues related to illegal ownership, dubious marketing schemes, and non-extensions of 30-year leases, the subsequent reporting will not be pleasant.

Incorrect Reporting On the Phuket Property Market

While some articles engendering negative publicity for the Phuket real estate sector may have been well intended, the foreign press sometimes do not understand what they are writing about.

Occasionally a foreigner finds a journalist with a sympathetic ear, but it is obvious that the reporter has not fully comprehended the true nature of the story they are covering. Sometimes the unfortunate event being written about was nothing but a poor decision made by a foreigner – a decision that could easily have been avoided – but this does not come across in the reporting.

It is possible (even likely) the foreigner should have had enough information to make an informed and intelligent decision, and could have avoided the predicament in which they found themselves. In some cases the foreigner actually violated the law by acquiring control over landed property, but the reporter has failed to mention this.

While we sympathise with anyone who has had bad luck (none of us wants to read about someone losing their home and/or their investment), it is important to note that bad publicity in the press is not necessarily the result of disreputable activity within the industry.

Sometimes it is, but sometimes individuals make avoidable mistakes. Unfortunately, reporters do not always take the time to uncover the truth behind the tale being spun by the aggrieved foreigner.

Unbiased (Largely Ignored) Reporting On Phuket Real Estate

This article from The Telegraph in the UK is from 2012. It clearly spells out the law as it pertains to buying land with Thai companies and nominee shareholders. It also quotes a Thai official who talks of the need to crack down on illegal foreign ownership.

The fact that this article was written 12 years ago, and that the actions being mooted by the authorities did not happen, should not make people more confident to continue with the same practices. It should instead serve as a warning that the Thai government has been aware for years that foreign ownership structures are being established which violate the spirit of Thai law.

People should know that changes in government, such as the recent one, often mean addressing new issues, which we hope will not mean a further crackdown on foreigners owning landed property. We do not believe that every new government will immediately address foreign property ownership as their first priority, but we also don’t believe they plan to ignore it forever.

Everyone in the Phuket property market is obviously in favour of a measure of restraint being shown, and of changes (or at least clarifications) being made in the law. We are eager to see what transpires.

A Change in Visa Rules When Entering Phuket

Will foreigners always be welcome in Phuket? We certainly hope so! But while foreigners have been welcome for decades, there have been periods of tightening (then relaxing) of immigration standards over the years.

This has manifested itself most noticeably in the restrictions on Visa Runs – quick day trips across the nearest boarder and back, for the purpose of “renewing” a 30-day visa on arrival. While this practice is still permitted, it is limited to two such trips over a land boarder (or six via an international airport) in a single calendar year.

We should never rule out tightening in other areas, and one visa category which could be vulnerable to a change in policy is work visas/work permits. A number of foreigners in Phuket have work permits issued by small businesses, in some cases, their own small business. Just as a closer inspection of Thai companies owning Phuket property is likely, it is possible that companies issuing work permits to foreigners could be looked into one day to ensure they are structured correctly, adhering to Thai corporate law, and are actually trading and hiring Thai employees.

Thailand understandably wants the foreigners living here for the medium to long term to be using proper visas. When it comes right down to it, this is no more than any western country demands of its visitors.

Extended stay visitors or anyone using a proper visa issued by a Royal Thai Embassy will likely be just fine. Likewise, we are confident that anyone over the age of 50 who is retiring in Thailand will always be welcome.

Summary of Key Driver’s Affecting Phuket’s Real Estate Market:

It should come as no surprise that there is a strong correlation between the number of tourists a country embraces each year, and the volume of investment properties sold to those foreign visitors.

The numbers do not lie. Tourism is the key driver of the property sector in Phuket. Infrastructure improvements have kept pace with increased numbers of foreign arrivals, and that investment made in infrastructure (e.g. airport, roads, public transportation) over the last decade should hopefully accommodate yet further growth in tourism.

The motivation for most Phuket property investors is either capital appreciation or income generation exceeding what they can receive from alternative types of investment. But investors and home owners alike should be aware that the road to profit and income can occasionally be choppy.

At the moment, the top buyers of property in Phuket are the Russians; not coincidentally they are among the largest groups of foreign tourists to the island each year. But they are not only purchasing holiday homes or rental properties. More and more people of every nationality are moving to Phuket for the lifestyle – either to work, retire or even to educate their children.

Future growth in the hospitality industry will certainly form the foundation of an expansion of Phuket’s real estate market. If the tourist sector takes a downturn, however, the property sector will be impacted too. There is no way to sugar coat this fact.

But we have seen multiple assaults on tourism in the last two decades, and Thailand has always bounced back. In the face of natural disasters, financial catastrophes, and global health scares the Phuket tourist industry may have blinked, but it has recovered each time, and continued to go from strength to strength. Just as the tourist economy has proven to be remarkably resilient, the Phuket property market has likewise demonstrated a buoyancy that keeps investors coming back to Phuket year after year.

Investors should be aware of the existence of the Black Swans of Phuket and factor this in to their purchasing decisions. That said, it would require some seriously bad luck, and some seriously cataclysmic Black Swans, for a property investment in Phuket to be anything other than a very lucrative investment over the next 20 years.

Key Drivers for the Phuket Property Market Articles

SECTION 15: Why Invest in Phuket Real Estate? A Look At All the Positives

There are many reasons why people fall in love with Phuket. Although the world is made up of a diverse range of people, everyone who visits Phuket begins their immediate love affair with this enchanting island. Today, the island comprises of a broad range of nationalities, possibly having nationals from pretty much every nation on Earth. Whatever their reasons for investing in, or even becoming residents of the island, nearly all of these people that come to Phuket have a positive attitude towards owning property here. This section covers all the positives associated with Phuket property sector right now, in 2024.

SECTION 16: Phuket’s Ongoing Infrastructure Improvements

Phuket was once an island covered in jungle, with fishing villages dotted around the coastline, and with Phuket Town servicing the tin mining industry. Since the 21st century began in earnest, the island has seen incredible expansion, in both population growth, as well as incredible infrastructure, with new attractions and amenities springing up every year. As the world adjusts to the post Covid era, with more tourists arriving and with more Thais and foreigners calling Phuket their home, this infrastructure improvement program is unlikely to ease off or slow down.

SECTION 17: Phuket’s Negatives – Taking Off The Rose Coloured Spectacles

Although the Phuket property market tends to move independently of every other real estate market in the world, including the rest of Thailand, (except perhaps Koh Samui), it has not always been smooth sailing. Without the excessive borrowing seen in most countries, it has certainly been a much smoother trajectory, without any booms and busts. However, the real estate sector in Phuket has historically gone through many slowdowns, where prices have stagnated for many years, as demand waits to pick up to soak up any supply excesses. This section covers what to keep an eye out for in the years ahead, allowing investors to plan accordingly.

SECTION 18: The Black Swans of Tourism

This topic deserves its own section, mainly because the tourism sector has always been, and still is today, the lifeblood of the island. Without tourism, Phuket would have never seen the prolific growth it has experienced over the past 30 years, nor would the Phuket property market have reached where it is today. But unforeseen events do occur every few years, sometimes quite suddenly and cannot be discounted in the future. These may be local, national or international, but many do end up having an adverse effect on Phuket Island and its economy.

Social Contact