SECTION 4: VALUING A PHUKET PROPERTY

Understanding Phuket Property Value vs. Price

When a seller lists a property in Phuket, the asking price reflects their perception of what the home is worth. However, the true Phuket property value is only confirmed when a buyer agrees to pay that amount. In other words, value is often more subjective than the listed price.

If no one is willing to meet the asking price, the property may be over-valued in the current market. That doesn’t necessarily mean it wasn’t worth that amount six months ago, or that it won’t reach that price again later, but right now, the true value could be lower.

Buyers Ultimately Determine the Property Market in Any Location

A home’s value is only as high as what a willing buyer will pay. Prices may continue to rise until they reach a point where no buyer is prepared to proceed, this is how property bubbles form and eventually burst. While this cycle happens in almost every country, Phuket’s market has its own unique dynamics shaped by tourism, lifestyle appeal, and limited prime land availability.

The insights below outline how both buyers and sellers in Phuket develop their ideas of a property’s worth, and how perceptions can differ dramatically.

Beauty Is in the Eye of the Beholder in the Phuket Property Market

This sentiment is especially true when it comes to valuing property in Phuket.

Someone new to the island may judge a home’s value based on what a similar property costs in their home country, or in other holiday destinations they’ve visited. Their perception can also be influenced by emotions, excitement, anxiety, or even the fear of missing out, all of which can cloud sound, objective decision-making.

In most countries, a condominium or pool villa can be valued by a professional assessor, with prices determined largely by comparable sales in the area. In Phuket, however, market value is far more subjective. Many buyers simply pay what they personally believe the property is worth, rather than what comparable sales might suggest.

Motivated or Unmotivated Sellers

In the past, distortions crept into the market when long-time owners, often not truly motivated to sell, decided to “test the market” by listing their Phuket properties at unrealistically high prices. This practice sometimes created artificially inflated price expectations for other nearby homes, villas, or condos.

Today, with such a wide variety of Phuket villas and condos available, this strategy rarely works. Buyers have more options and can easily compare prices, quality, and location. However, occasional cases still arise where a property sells at an inflated price, setting a misleading benchmark for others in the same area. This can influence how some sellers price their homes, even when the market data doesn’t support it.

For buyers, the key is to focus on actual market value, not just the seller’s aspirations. Working with an experienced local real estate agency can help ensure you’re comparing like-for-like properties and avoiding inflated prices. You can also browse our current Phuket property listings to see realistic asking prices across different areas and property types.

Relative Value of Property in Phuket

Simply put, “relative value” refers to determining the worth of an asset by comparing it with similar assets at a given point in time. In this context, we are not talking about comparing one Phuket property to another. Instead, we mean assessing Phuket property prices relative to the prices in the home countries of prospective buyers.

For many international buyers, this comparison is eye-opening. The low interest rate environment that followed the 2008 global credit crunch created overheated and often overpriced real estate markets in many parts of the world. Compared to those inflated markets, Phuket’s villas and condominiums can appear to be exceptional value, specially when set against the island’s natural beauty, tropical climate, and relaxed lifestyle.

This perception of value often encourages buyers to act quickly, sometimes without fully considering local market trends. That’s why it’s essential to compare more than just the price tag, factors such as location, build quality, and long-term appreciation potential all play a role in a property’s true worth.

Different Buyers, Different Priorities in the Phuket Property Market

Just as no two people are the same, there’s no such thing as universal appeal when it comes to Phuket real estate. What makes one property irresistible to a particular buyer may be a complete turn-off for another.

For example, some buyers are drawn to Phuket for its lush greenery and actively seek peace and solitude. These individuals may avoid busy tourist hubs, preferring a tranquil retreat far from the crowds, shops, and nightlife, which could be exactly what attracts someone else.

Families with children often place proximity to an international school above all other considerations when choosing a home. For them, location can outweigh factors such as sea views or nightlife.

Phuket’s buyer demographic has grown increasingly diverse, with residents from all corners of the globe. Many are married to Thai nationals, creating a broad range of tastes, lifestyles, and housing preferences.

The age profile has shifted as well. Two decades ago, most expatriates were retirees or established professionals. In recent years, the rise of digital nomads has introduced a younger wave of buyers, lowering the average age of expatriates significantly.

If you’re looking for a home that matches your lifestyle, whether that’s a peaceful hideaway, a vibrant hub, or a family-friendly neighbourhood, ask Thai Residential for our expert help.

North, South, East or West: Choosing the Best Area to Buy Property in Phuket

The personality and lifestyle of Phuket’s regions can be as varied as the people who live in them. For foreign buyers, understanding these differences is essential when deciding where to purchase a home.

For those commuting frequently to Bangkok, Hong Kong, or Singapore, proximity to the airport is a priority. Buyers in this situation often choose property in the north of Phuket, reducing travel time and making weekend visits with family easier.

The west coast is the island’s most in-demand region, famous for its golden beaches, sunset views, and crystal-clear waters. Stretching from Mai Khao in the north to Kata Noi in the south, this area commands premium prices, particularly for beachside villas or properties with panoramic sea views. Historically, the west coast has also delivered the strongest rental returns.

The south, home to Rawai and Nai Harn, offers its own stunning beaches with turquoise waters and a relaxed, community-oriented atmosphere. Known for its large expatriate population, scenic surroundings, and excellent restaurants and cafés, it remains a favourite for those seeking a quieter lifestyle. Despite rising demand, pool villas here are still attractively priced.

On the east coast, development has been more restrained. While it features exclusive marinas and a handful of luxury estates, land is generally cheaper. Many homes boast spectacular views over Phang Nga Bay, making it a good option for buyers seeking privacy and value away from the busier west coast.

The central valley, particularly Kathu, offers a green, scenic setting with some of Phuket’s best golf courses and convenient access to Patong. Golf enthusiasts often find attractive villa options here, with prices that fall between the higher west coast and the more affordable east coast.

The areas of Thalang and Cherng Talay have seen rapid growth, driven by easy access to both beaches and the airport, as well as nearby international schools such as UWC and Headstart. Luxury pool villas here are in high demand, and prices have risen faster than in most other parts of the island.

Phuket Town offers a vibrant mix of culture, history, and modern amenities, with an increasing number of foreign buyers attracted by its proximity to hospitals, shopping centres, high-end restaurants, and a lively nightlife. Despite growing interest, property prices remain lower here compared to the west coast.

New vs. Old Properties: What Buyers Value Most in Phuket

In recent years, demand for property in Phuket has grown rapidly, prompting developers to launch more new projects than at any other time in the island’s history. Today’s market leans heavily toward new villas and condominiums with sleek, modern designs, as opposed to the more traditional styles that were popular a decade ago.

When valuing property in Phuket, age and upkeep play a huge role. The data shows that resales tend to be less attractive to buyers than brand-new builds. Freshly completed developments have that “showroom appeal”, they are pristine, stylish, and often come with added benefits such as guaranteed rental returns, full management services, and even early-buyer discounts for off-plan purchases.

By contrast, older homes can carry signs of wear and tear, even if well-maintained. Sellers who have lived in the property for years may overlook these flaws, but buyers notice every detail. In Phuket’s competitive market, where new properties dominate sales, owners of older homes must price realistically and be prepared to make improvements if they want a faster sale.

While it’s certainly possible to sell an older property for a fair price, ignoring current market trends can lead to a home sitting unsold for months – or even years.

A Little Goes a Long Way: Paying Attention to Detail

Many sellers fail to maximise the selling potential of their Phuket villa or condo. Often, a property could achieve a substantially higher price if the seller invested a small amount in mostly cosmetic improvements. Buyers will not purchase unless they feel a “connection” to the property, and an otherwise marketable home may be selling itself short because the owner does not recognise its shortcomings or is unwilling to address them.

There are also countless properties available for rental that could perform far better with just a few small tweaks. In fact, the rental potential can be boosted significantly with only a modest outlay, and higher rental income naturally increases the re-sale value of the property.

It’s not always about major renovations. Simple changes to lighting, layout, and finishing touches can be the difference between a mediocre and a stand-out property in Phuket. While some enhancements have universal appeal, the value of any Phuket property is ultimately subjective, someone will only pay what they believe it is worth.

CALCULATING THE P/R RATIO ON A PHUKET INVESTMENT PROPERTY

A = Property Value: THB 27 million

B = Rental Income: THB 1.8 million per annum

The P/R Ratio is A ÷ B = 15

A P/R Ratio between 15 and 20 typically represents good value. A P/R higher than 20 should be considered inflated, while anything below 15 would represent a potentially excellent investment property.

The Home Price to Rental Income Ratio

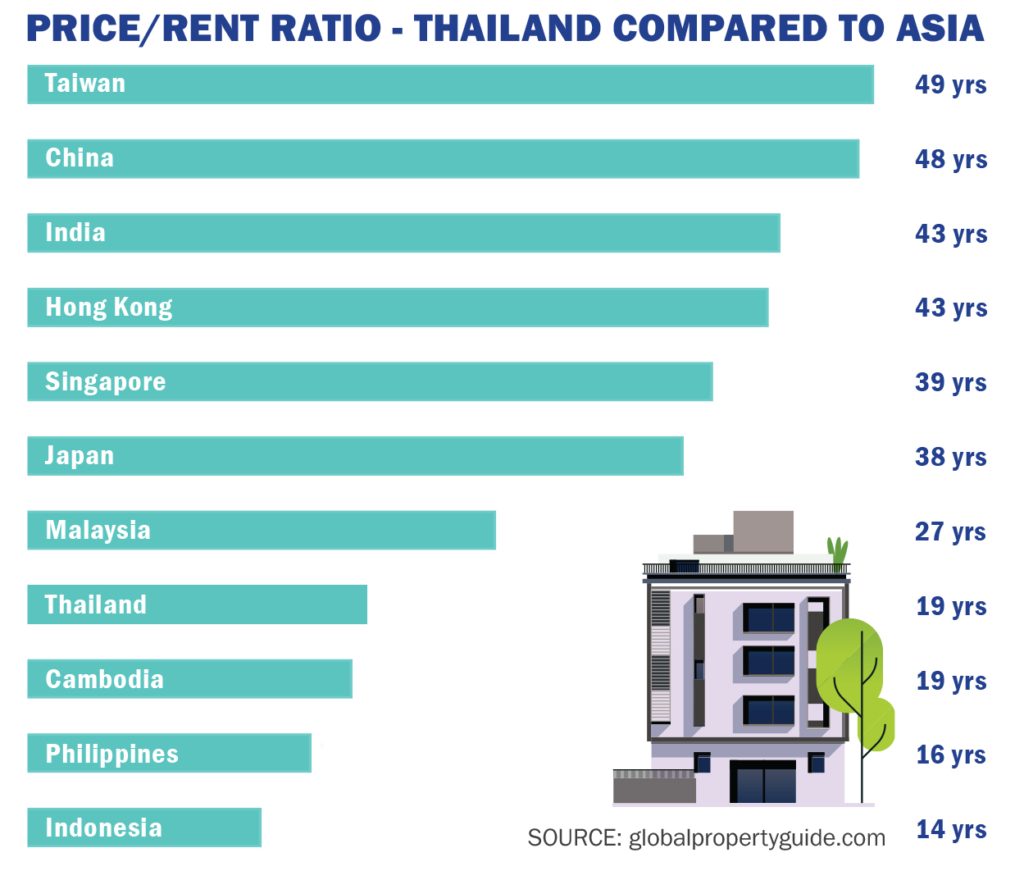

One of the most reliable ways of valuing property in Phuket, especially for investors, is by comparing the potential rental income to the market price. This method, widely used around the world, is similar to how a Price/Earnings Ratio (P/E ratio) is used to value companies. In real estate, the equivalent is the House Price-to-Rental Income Ratio (also known as the Price/Rent Ratio, or P/R Ratio).

The formula is straightforward: divide the sale price of the property by the annual rental income it could generate. A high P/R Ratio suggests the home price is inflated compared to its earning potential, while a low P/R Ratio usually signals a more attractive investment opportunity.

For example, a P/R Ratio of 15 means the rental income would repay the property’s purchase price in 15 years. For buyers seeking strong rental returns, a favourable P/R Ratio is essential. However, if the asking rent is set too high, the property could remain empty for extended periods, lowering overall returns.

In recent years, ultra-low global interest rates and rising demand since COVID have shifted traditional expectations. Some buyers today are happy to accept lower yields in exchange for consistent occupancy and the potential for long-term capital appreciation. Even in a softer rental market, owners may prefer a steady income stream, even at a reduced yield, over leaving the property vacant.

If your main motivation is rental income, take the time to research Phuket’s rental market and compare yields across different areas and property types.

Unless the rental market is booming, it’s often wiser to secure a steady rental income than to keep a property empty in the hope of charging higher rents later. When the time comes to sell, most serious buyers will want to review the rental income history, and this track record can have a direct impact on the final selling price.

In many cities and prime destinations around the world, Price/Rent ratios remain very high, sometimes as much as 50 or 60. In those markets, most owners are not focused on rental yield but on using the property themselves or banking on long-term capital appreciation. This doesn’t necessarily mean rents are low, just that they are relatively low compared to purchase prices.

Phuket’s real estate market, while unique compared to the rest of Thailand, generally offers more favourable P/R ratios than many global hotspots. For lifestyle buyers, this means better value; for investors, it often means a stronger balance between income potential and capital growth.

A growing number of new developments in Phuket now offer full-service rental management. This can include everything from insurance and utilities to hotel licensing, maintenance, marketing, and guest services. These packages make it easy for owners to earn consistent returns without the day-to-day hassle. In fact, a guaranteed 5% net return can translate to a gross equivalent of around 7% (P/R ratio of approximately 14), which is considered excellent value.

It’s worth noting, however, that guaranteed returns are offered only for a fixed term. Once they expire, rental income may fluctuate. Understanding the cycles, especial with erratic tourists number, and planning for it, is essential for any buyer seeking reliable returns from their Phuket property.

In today’s market, some buyers are happy to accept lower rental yields than in previous years, preferring a consistent income stream over leaving a property empty in the hope of higher rents. Even when the rental market softens, steady occupancy can help maintain value. Any serious buyer will look closely at rental history before making an offer, and this track record can directly influence the selling price.

Varying Material and Build Quality in Phuket Condos and Villas

A property in Phuket might look stunning at first glance, but what’s underneath the paint and plaster tells the real story. Buyers should take time to investigate the materials and construction methods used, from the foundations and roof structure to the quality of walls, windows, and interior finishes.

Developments that hire respected architects often deliver both exceptional design and solid build quality. Top architects value their reputation, so they are unlikely to put their name to anything substandard. This usually means premium materials, high-grade fixtures and fittings, well-crafted kitchens, and thoughtful finishing touches, all of which add long-term value.

Before committing, ask yourself: “Was this property built to a standard that will still look and feel solid in 10 or 20 years?”

In Phuket’s tropical climate, that question can make all the difference between a wise investment and a costly mistake.

The Price per Square Metre of Phuket Condominiums

Why Price Per Square Metre Matters in Phuket’s Condo Market

In Phuket, price per square metre is often a deciding factor for buyers, especially when it comes to condos. Many investors here want to maximise the amount of space they get for their budget, and that figure can drive the final decision.

In other parts of the world, such as Europe, Australia, or North America, buyers might focus less on size and more on whether the property simply fits their lifestyle and needs. But in Phuket’s condo market, the cost per square metre can carry outsized importance.

It’s usually easy to see why a THB 85,000/m² unit is priced far below one at THB 200,000/m². But it’s not always obvious why two similar condos in the same area might have very different price tags.

While overall demand in the Phuket property market does influence prices, developers often set their rates not just on market forces, but also to achieve their target profit margins. Those who use premium fixtures, high-end finishings, and fully equipped Western kitchens will typically command a higher price per square metre than those who don’t.

What Really Drives Price Per Square Metre in Phuket

Sometimes, price per square metre isn’t about build quality at all, it’s simply demand. When new condo units are selling quickly, developers may raise prices during the launch period to maximise profits.

While most Phuket condo projects are selling well, some move faster than others. If a price is set too high and fails to attract buyers, the developer will have to lower expectations.

Location plays a major role. Generally, the further inland you are, the lower the price per square metre. Beachfront and sea-view properties command the highest prices, while urban or inland condos offer more space for the money. For example, Kathu is far more affordable than nearby Patong, even though they’re just minutes apart. The west coast averages around THB 120,000/m², but prime sea-view units often sell for far more.

Scarcity and density also affect averages. Two similar condo resorts may have vastly different unit counts, skewing average price data. In some cases, a mostly undeveloped area might appear expensive because of one or two luxury projects, even if surrounding land is much cheaper.

This pattern is seen on Phuket’s East Coast, where traditionally lower land prices have been overshadowed by a few high-priced developments. While land in high-demand areas is scarce, there is still a good amount available elsewhere, meaning not all “island prices” are justified.

For villas, buyers should confirm whether the quoted price per square metre is based on built area, usable area, or internal living space. Figures can vary depending on whether patios, terraces, gazebos, balconies, garages, or carports are included. A large patio may lower the calculated price per square metre, but it won’t necessarily add to the actual living area.

Summary

The price of property in Phuket is generally higher than in other provinces of Thailand, and in some cases may even be comparable to prime locations in Bangkok. Compared to many other world-class holiday destinations, however, both condominiums for sale in Phuket and private Phuket pool villas still offer exceptional value for money on a cost-per-square-metre basis.

Square metre pricing is a useful benchmark to gauge whether a property sits at the low or high end of the local market, but it is only one piece of the puzzle. Factors such as location, build quality, land size, facilities, rental potential, and long-term appreciation prospects all play a role in determining value.

For serious buyers, it’s worth looking beyond the numbers to assess whether the property truly meets your needs, whether that’s as a personal residence, a holiday home, or an income-generating investment. If you are considering buying property in Phuket, working with the island’s most knowledgeable and trusted real estate professionals can help you identify the best opportunities, negotiate the right price, and avoid costly mistakes.

If you haven’t already done so, you may also want to read our informative article on the factors affecting Phuket property prices:

The information contained in the Phuket Property Guide and all related Thai Residential articles is provided for general informational purposes only and does not constitute legal or financial advice. Property laws and regulations in Thailand are subject to change. Readers should seek independent legal counsel or official confirmation from the relevant authorities before entering into any property transaction or investment.

Social Contact