SECTION 9: FOREIGN FREEHOLD CONDOMINIUMS EXPLAINED: COMPLETE GUIDE

Making the Right Choices

Foreign freehold ownership in Phuket is rather limited to foreigners. As investing in any type of property is always a major decision, buyers naturally want the reassurance that their purchase is both secure and strategically sound.

In most countries, property ownership laws are relatively straightforward. However, in Phuket, and throughout Thailand, foreign buyers are prohibited from owning land, which includes landed property such as villas and houses. The exception is foreign freehold condo ownership in Phuket through registered condominiums. These can be purchased in a foreign buyer’s own name and recorded at the local Land Department, offering a clear and legal title.

With the correct information, buyers can make confident decisions and avoid the inaccurate claims or misleading advice that can sometimes come from less-scrupulous agents or developers. Unfortunately, many investors only discover they have made costly mistakes, or even breached Thai law, after the fact.

This guide is designed to explain the legal framework in detail, helping discerning investors navigate the Phuket property market with clarity. Over the next two sections, we will cover every lawful option for foreign ownership, including securing a villa via leasehold agreements or freehold title through a Thai Limited Company.

First, let’s begin with the most straightforward and secure route: foreign freehold condo ownership in Phuket.

Find your new Phuket Property with Thai Residential

Current Legal Framework for Foreign Freehold Property Ownership in Phuket: Condominium Laws

When it comes to foreign freehold property ownership in Phuket, condominiums offer the clearest and most secure path. Under Thai law, up to 49% of the total saleable area in any condominium development can be owned by foreigners, with the remaining 51% reserved for Thai nationals.

A condominium title grants ownership of your individual unit as well as a “fractional interest” in the building’s common areas, including the swimming pool, gym, landscaped gardens, car park, and reception. This title should state both the size of your private unit and the proportion of the shared facilities you own. That same percentage also determines your voting rights within the owners’ association.

The main advantage of foreign freehold ownership in Phuket through a condominium is that it can be held permanently in your own name, with no time limits, until you choose to sell. In addition, inheritance laws are generally more favourable than those for leasehold villas, allowing foreign owners to pass the property to their heirs, although the rules are not without some complexity.

There is some overlap, and occasional conflict, between different laws governing foreign freehold property ownership in Phuket. Under the Condominium Act, any foreigner who inherits a condominium must notify the local Land Office within 60 days. If the heir does not meet the eligibility criteria for foreign ownership, they may be required to sell the property within one year of the owner’s death.

Meanwhile, the Thai Civil and Commercial Code (CCC) states that the legal right to own the property passes to the heir along with the property itself. This has been the Land Department’s formal interpretation, that the deceased owner’s right to hold a freehold title transfers upon death, but there is still insufficient case law to guarantee permanent ownership for the heir in every scenario.

One of the key requirements under the Condominium Act is a Foreign Exchange Transaction Form (FETF) in the condo owner’s name. To make inheritance smoother, buyers can request that their overseas bank include multiple names on the telegraphic transfer when sending funds to Phuket. This allows the Thai receiving bank to list all names on the FETF, making succession far less complicated.

The names listed on the FETF must also be recorded as co-owners of the condominium. This helps secure the inheritance rights of all parties should the principal buyer pass away. Another succession planning option for foreign freehold property ownership in Phuket is to register the condo under an offshore company name, as the FETF will then be in the company’s name.

However, if the authorities apply a strict interpretation of the Condominium Act, instead of the more favourable CCC interpretation, the process can become more complex. In such cases, an heir wishing to keep the property may need to transfer into Thailand an amount equivalent to the purchase price of the unit. This means, counterintuitively, that someone could be required to “buy” the very condo they have just inherited.

The FETF process and the five requirements (or “Doors”) to foreign condominium ownership in Phuket are covered in more detail in the insights shared by Sam Fauma of ILO below.

If you are considering buying a condominium in Phuket, our step-by-step guide covers how to purchase correctly, legal safeguards, and what to expect along the way:

How to Secure a Condo in Phuket: The Complete Guide

WHAT SAM SAYS ABOUT “THE FIVE DOORS”

WHAT SAM SAYS ABOUT “THE FIVE DOORS”

Section 19 of the Condominium Act has “Five Doors” relating to the ownership of a Phuket condominium by a foreigner. If any one of the following conditions are met, the foreigner may proceed to purchase a condo in their own name, provided not more than 49% of that development is already foreign owned.

Section 19: An alien person or a juristic person deemed alien by law may have an ownership in a unit if it satisfies the following conditions:

1: The person obtains a residence permit in accordance with immigration law;

2: The person obtains a permit to enter the country in accordance with the law on investment promotion;

3: The person is a juristic person under section 97 and section 98 of the Land Code, registered as a juristic person under Thai law.

4: The person is an alien juristic person under the Announcement of the Revolutionary Council No. 281, dated the 24th November B.E. 2515 (1972), and obtains an investment promotion certificate in accordance with the law on investment promotion.

5: The person is an alien person or a juristic person deemed alien by law, bringing foreign currency into the country, withdrawing funds from a Thai Baht account of a person having a place of residence outside of the country, or withdrawing funds from a foreign currency-based deposit account.

Number 5 is obviously the FETF, which is the most common “door” foreigners use to buy a condo, but satisfying any one of the five is enough to qualify for freehold foreign ownership of a condominium in Phuket.

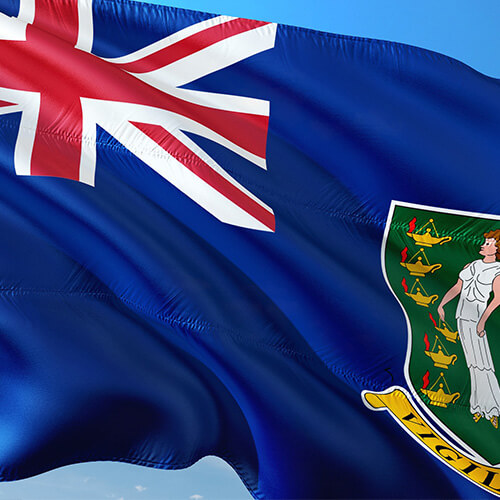

Using a British Virgin Islands (BVI) Company to Own a Property in Phuket

For some buyers exploring foreign freehold condo ownership in Phuket, succession planning is a key consideration. One effective approach is to purchase a condominium, or in some cases a villa, through an offshore company.

While companies can be registered in jurisdictions such as the Seychelles, Mauritius, or the Turks and Caicos Islands, the British Virgin Islands (BVI) remains the most popular choice for property holding. BVI companies are well established, globally recognised, and offer competitive annual running costs, making them a preferred option for long-term ownership and inheritance planning.

It is important to draw a clear distinction between using an offshore company to own a condominium in Phuket and using a Thai company to bypass landed property ownership restrictions. (The latter practice is covered in detail under “Phuket Villas, Houses and Landed Property”). In this case, we are referring to the fully legal purchase of a freehold condominium, not by a foreign individual, but by a properly registered foreign company. Offshore company ownership solves the inheritance challenge because companies, unlike people, do not die.

Through a BVI company, the buyer controls the condo’s ownership by controlling the company’s shareholding. If they later wish to sell, they can simply sell the BVI company itself. Transferring company shares automatically transfers ownership of the condo, although this may not be cost-effective for lower-priced units.

Setting up a BVI company typically costs a few thousand dollars, with annual running costs just over $1,000 per year. For a $100,000 studio condo, the extra expense may not be justified, but for an $800,000 sea-view Phuket penthouse, it can be an obvious choice, especially for those committed to secure foreign freehold property ownership in Phuket for the long term.

There is also the question of what corporate ownership entails under Thai law. If an offshore company owns the property, there are potential tax consequences. Even though audited accounts are not a statutory requirement in the BVI, the company must still file a balance sheet in Thailand detailing any rental income and related financial activities. Furthermore, if the foreign occupant is a director of the offshore company, their “free rent” is deemed to be a benefit in kind from the company. The individual must then pay income tax on the fair market value of the annual rent received as a benefit.

Finally, if the condo is sold, the BVI company must pay corporate tax in Thailand on any capital gain. If the purpose of the company is purely ease of inheritance, this last tax liability can often be avoided by simply transferring ownership of the company instead of the condo itself.

When the property is ultimately sold, however many years in the future that may be, the freehold title will be transferred away from the BVI company. At that point, the ultimate seller (the final owner of the company) will have to pay income tax based on the total capital gains earned on the property since its original purchase, which can be significant for long-term property ownership in Phuket.

Condotels and Hotel-Licensed Condominiums in Phuket

A Condotel is a hybrid species of Phuket real estate combining the services of a hotel and a condominium. It is a common concept in other parts of the world, which permits individual units to be privately purchased, and then rented as hotel accommodation. In short, this type of foreign freehold condo ownership in Phuket, is for anyone purely interested in investment, so not for someone seeking a second home or a personal holiday retreat.

For investors interested in foreign freehold property ownership in Phuket, Condotels present an attractive legal option. The owner of a Condotel unit may rent it out on a monthly, weekly, or even daily basis. (For anyone who has followed the restrictions being placed on Airbnb by cities and countries around the world, this is a huge advantage for any property investor.)

A hotel management company is typically employed to run the resort, and these companies all have attractive rental programs. The owner is usually allocated a fixed number of days per year to use their unit, but for the remainder of the time the management company treats the unit as a normal hotel room. Under most arrangements, they also take care of maintenance and repairs to the unit.

Most Phuket Condos set up with hotel licenses offer either a guaranteed return or the option to enter into a “rental pool,” which requires the owner to make their unit available for rental (together with the other participating owners). The owners then “pool” the rental income, and share together in the profits.

The attraction of a Condotel investment, as a means for foreign freehold ownership in Phuket for a foreigner is obvious. Firstly, they are permitted to own a Phuket freehold condominium unit in perpetuity. Secondly, they are legally allowed to have the rental of their unit managed for them by a professional hotel management company. They can therefore take advantage of Thailand’s flourishing real estate sector, while simultaneously capitalising on Phuket’s booming tourism industry. At the same time, they can also enjoy “free” accommodation in Phuket for a few weeks every year.

To function effectively as a condo, as well as a hotel, a Condotel development should apply for commercial use on day one. It is theoretically possible for the juristic person at a condominium to allow (or at least condone) short-term rentals, effectively “commercialising” the condo for use as a Condotel. If the juristic person chooses to allow this, the agreement of the owners is not required. But to apply for the hotel license, thus officially making the development into a Condotel, not only must the juristic person agree, but this legal commercialisation of the common area also requires the assent of 100% of the owners.

It is unfortunate that many Phuket condominium projects were rushed into development without first contemplating their use as a hotel. Shorter-term rentals (e.g. daily and weekly) are technically illegal in Thailand without a hotel license, yet many condominium developments offer guaranteed returns based largely on the short-term rental market.

It is also possible that many of the people profiting from short-term rentals are not paying tax on their income. Anyone who gets to know Thailand soon understands that nothing is a problem until lawmakers decide to take action. In other words, everything is OK… until it isn’t.

If Phuket should experience a slowdown in tourism, hoteliers may campaign in strength for an end to illegal short-term rentals. Any development already run with a hotel license would of course be immune from the potential backlash. So, if hoteliers were successful in any such campaign against short-term rentals, Condotels, especially those offering foreign freehold property ownership in Phuket, would profit right along with them.

You can read more about the situation with short term rentals in our article on the subject here:

An Overview on the Current Situation of Short-Term Rentals in Phuket 2025

Branded Residences and Foreign Freehold Property Ownership in Phuket

Phuket’s luxury real estate market also offers a unique hybrid of hotel living and an investment that can be owned freehold by foreigners. While some branded residences in Phuket are private villas, many are legally structured as condominiums, allowing foreign freehold property ownership in Phuket under the Condominium Act.

The appeal for high-net-worth investors is clear: ownership in a residence managed to the exceptional standards of a world-class 5-star hotel brand, often with access to a rental pool program if the owner is not living on site. Buyers enjoy the prestige, service, and design synonymous with luxury hospitality, combined with the convenience of fully managed property maintenance.

Globally, the popularity of branded residences has surged over the last two decades. While the USA holds roughly one-third of the world’s total, there are now more than 50,000 branded residence units across 400 developments worldwide.

The concept dates back to 1927 when the Sherry-Netherland Hotel opened on Fifth Avenue in New York. Although other examples followed, the sector truly regained momentum in the 1980s, when Four Seasons launched condominiums alongside its Boston hotel. Phuket joined this elite market soon after with the Amanpuri, which transformed the concept with its tropical resort setting.

In the last 30 years, over 70 hotel groups have entered the branded residence market. Notably, the boom periods for these developments, the 1920s, the 1980s, and today, have all coincided with global surges in wealth creation.

According to UBS’s Global Wealth Report 2025, there are now over 60 million millionaires worldwide, and Forbes estimates nearly 2,800 billionaires. In the last decade alone, these numbers have more than doubled.

This rising wealth is excellent news for Phuket’s branded residences. Priced above traditional condominiums, they deliver unmatched value through world-renowned architecture, exquisite interior finishes, exceptional resort amenities, and breathtaking views. The hotel brand association not only helps them command premium sales prices but also ensures strong rental demand at top market rates.

In Thailand, branded residences have proven especially popular with wealthy domestic buyers. In Phuket, where up to 49% of a condominium development can be sold freehold to foreigners, the remaining 51% is often eagerly taken up by Thai investors. This demand suggests the luxury condominium sector will continue expanding Phuket’s collection of branded residence investment opportunities that align perfectly with the benefits of foreign freehold ownership in Phuket.

The first branded residence in Thailand was the iconic Amanpuri in Phuket, which redefined the concept by combining luxury hotel services with private ownership in a tropical resort setting. Its success set the stage for Phuket to become one of Asia’s leading destinations for this type of investment.

Over the past three decades, the sector has expanded rapidly, with more than 70 global hotel brands now offering branded residences worldwide. The timing of each growth surge, from the 1920s origins, to the 1980s revival, to today’s unprecedented expansion, has coincided with significant global wealth creation.

According to UBS’s Global Wealth Report 2024, there are now 58 million millionaires and almost 2,800 billionaires worldwide. Both figures have more than doubled in the last decade, signalling a deepening pool of buyers with the resources and appetite for high-end branded property.

This demographic shift is excellent news for Phuket’s branded residences. While priced above conventional condominiums, they offer exceptional value for money through world-class architecture, bespoke interior design, and meticulous attention to detail. In Phuket, these residences are often set within lush resort grounds, featuring outstanding amenities and spectacular sea views.

The prestige of a luxury hotel brand not only drives higher resale values but also ensures consistent rental demand at premium rates. This dual appeal, as both a lifestyle investment and an income-generating asset, makes them an attractive option for foreign freehold property ownership in Phuket as well as for wealthy Thai investors.

In a Phuket condominium project, up to 49% of the units can be sold foreign freehold, with the remaining 51% typically absorbed by domestic buyers. With strong demand from both Thai and foreign investors, the luxury condominium market in Phuket is set to deliver more branded residence projects, blending five-star living with secure foreign freehold ownership in Phuket.

Buying and Leasing Property in Phuket Articles

SECTION 17: Phuket’s Ongoing Infrastructure Improvements

Phuket was once an island covered in jungle, with fishing villages dotted around the coastline, and with Phuket Town servicing the tin mining industry. Since the 21st century began in earnest, the island has seen incredible expansion, in both population growth, as well as incredible infrastructure, with new attractions and amenities springing up every year. As the world adjusts to the post Covid era, with more tourists arriving and with more Thais and foreigners calling Phuket their home, this infrastructure improvement program is unlikely to ease off or slow down.

SECTION 18: Phuket’s Negatives – Taking Off The Rose Coloured Spectacles

Although the Phuket property market tends to move independently of every other real estate market in the world, including the rest of Thailand, (except perhaps Koh Samui), it has not always been smooth sailing. Without the excessive borrowing seen in most countries, it has certainly been a much smoother trajectory, without any booms and busts. However, the real estate sector in Phuket has historically gone through many slowdowns, where prices have stagnated for many years, as demand waits to pick up to soak up any supply excesses. This section covers what to keep an eye out for in the years ahead, allowing investors to plan accordingly.

SECTION 19: The Black Swans of Tourism

This topic deserves its own section, mainly because the tourism sector has always been, and still is today, the lifeblood of the island. Without tourism, Phuket would have never seen the prolific growth it has experienced over the past 30 years, nor would the Phuket property market have reached where it is today. But unforeseen events do occur every few years, sometimes quite suddenly and cannot be discounted in the future. These may be local, national or international, but many do end up having an adverse effect on Phuket Island and its economy.

An Economic Overview for Thailand Property Investors

Explore the current economic landscape shaping Thailand’s property market. This in-depth overview highlights key growth indicators, foreign investment trends, infrastructure development, and what they mean for real estate opportunities in Thailand. Ideal for investors seeking insight into ROI potential, market stability, and future forecasts.

SECTION 9: Foreign Freehold Property Ownership in Phuket: Complete Condominium Guide

Condominiums are the safest way for foreigners to purchase real estate in Phuket. Condominium law allows 49% of the living area in each condominium project to be sold to foreigners as foreign freehold. Foreign freehold ownership means the foreigner will own the condo unit in perpetuity i.e. forever. This ownership is registered at the local Phuket Land Department. If a foreigner is considering buying property in Phuket, then this article explains everything you'll need to know, and why a Phuket condominium is the best option!!!!

SECTION 10: The Option of a 30-Year Leasehold When Buying a Villa in Phuket

We do not necessarily dispute the concept of a Phuket leasehold, however, anyone entering into a Phuket landed property leasehold, must be aware of all the risks associated with this type of legal arrangement. A leasehold in Phuket is very safe, in the sense that it guarantees you a 30 year lease period, but any term over and above this initial 30 year period must be viewed as a mere verbal promise. It is not guaranteed. It is simply a verbal guarantee to extend the lease for further renewals, but if denied, it is questionable whether it will upheld in a court of law in the favour of the foreigner.

SECTION 11: Using a Thai Company Limited To Own Villas, Town Homes and Landed Property in Phuket

It is possible for a foreigner to own a Thai company in Phuket, if the Thai company is adhering to all the corporate laws of Thailand. However, if that Thai Company owns landed property, there are other implications. A company set up with the sole existence of owning property for a foreigner, with shareholders, who have not invested in the Thai company, and who the foreigners does not even know, are deemed as nominees. This is illegal. All foreigners entering a sale and purchase agreement in which they either transfer ownership of shares of a Thai Company Limited, or set up their own Thai Company must know these rules and the laws governing Thai companies, and the legal implications of their company owning land in Phuket.

SECTION 12: Evolution of the Phuket Property Sector – Why So Many Foreigners Own Villas Illegally

Foreigners in Thailand are not allowed to own land. However, over the last few decades, it has been commonplace for foreigners to set up a Thai company, which allows them maintain control of the company which owns the physical land. This is all fine, if done correctly. It really depends on whether the Thai company is adhering to all the corporate laws of Thailand, and if everything is done correctly, such as the company having legitimate Thai Shareholders. If everything is set up correctly, it may be acceptable to the authorities. This section explains why and how so many foreigners today are blatantly violating Thai laws, and for the most part, most have no idea they are doing so.

SECTION 13: An Overview On The Thai Baht

When any foreigner invests in Phuket property, they are also exposing themselves to the Thai currency. Any fluctuations in the Thai Baht to, obviously affects their investment value, depending on how the Thai Baht strengthens and/or weakens against their home currency. They make gains if the Thai Baht strengthens, yet they make losses when the Thai Baht weakens. However, the situation is different for buyers, who may hold off on a purchase should the Thai Baht get too strong. Currency fluctuations play a major part in the Phuket real estate market dynamics.

SECTION 14: Transferring Money into Phuket

If transferring money into Phuket to purchase a Phuket property, it is important to seek legal advice. Many foreigners make the mistake of transferring money into Thailand and then later finding out they can’t purchase the condominium (or building) without sending the money back out of Thailand again and sending it back in to get the correct documentation. This happens quite frequently, because many foreigners decide to move to Phuket without understanding the laws and procedures. This is especially the case with a condo purchase, as it is important to understand how important the FETF is when registering the condo in the buyer’s name, as well as repatriating the funds back the buyers home country upon sale.

SECTION 15: Government Fees and Taxes on Property Purchases (Overview)

Government fees and taxes are low in Thailand compared to most other countries. In fact, they are some of the cheapest in the world, which is a big attraction to potential Phuket property buyers. Although taxes and fees are easy to understand, they depend on the given situation, legal structure, and whether it is a new build or a resale condominium unit or a villa. A reputable lawyer will be able to ascertain the taxes due on any property purchase.

Overview of Phuket Real Estate Market

The Real Estate market in Phuket is correctly described as being unlike any other real estate market in the world. A mere 660 metres from the Thai mainland across the Sarasin Bridge, Phuket's property market differs even

SECTION 3: What Drives Real Estate Prices in Phuket

Real estate prices for both villas and condominiums in Phuket is governed by land values, labour costs and raw material costs. All of these have risen significantly over the past few years, but land values have been the driving force in the rise of property values over the last 3-4 years. This section aims to educate buyers on what drives prices in Phuket, both historically, presently, and moving forward. With a better understanding of the Phuket property market, buyers will be able to make discerning and educated decisions, before they purchase.

SECTION 4: Guide On How to Accurately Determine Phuket Property Value

It is a known fact in the Phuket real estate industry that the true tangible price of a property is based solely on the final agreement made on price, between both the buyer and the seller. Of course, some buyers overpay for a property and have trouble selling again later. But the attraction and value of any singular property in Phuket is subjective, and beauty is in the eye of the beholder. A seller believes their property is worth a specific price, but the reality is that they will only achieve that asking price if one of the multitude of buyers agrees that the offer price is acceptable. If a property stays on the market for years, then the property is likely extremely overvalued.

SECTION 5: Rental Demand & Yields in Phuket

SECTION 5: PHUKET PROPERTY VALUE BASED ON RENTAL INCOME ALWAYS HIGH DEMAND FOR PHUKET RENTAL CONDOS AND VILLAS Although the post-Covid era has changed the Phuket real estate landscape, with a

SECTION 6: The Different Types of Phuket Property

There are many different types of Phuket property, with an array of different legal structures. This section assists to identify the different types of Phuket property for sale in Phuket. Although the various types are easy to define, sometimes these categorisations may overlap, creating even further sub-categories. If anyone is a serious buyer, it pays to understand the various types of properties that may be on offer in Phuket and to understand the legal connotations explained in later sections.

SECTION 7: The Inherent Risks to Buyers a Buyer Should be aware of: What Every Buyer of Property in Phuket Needs to Know

Foreigners who arrive in the “Land of smiles”, are mesmerised by how beautiful the Kingdom of Thailand is, and that surely in such an incredible place, full of such nice people, nothing can go wrong. Unfortunately, things often go wrong in Phuket, through either unfortunate circumstances, deliberate intentions or through the bereavement of the original lessee or land owner who made promises that the heirs refuse to accept. Buyers also need to be aware that many properties in Phuket are built illegally, and so the sale of the property at a later date, sometimes proves impossible.

Phuket Zoning Laws & Building Restrictions: A Guide to Legal Requirements

Before building or buying land in Phuket, it’s essential to understand zoning laws, height limits, floor area ratios, and environmental restrictions that may affect your project.

SECTION 8: The Importance of Sound Legal Advice for Foreigners in Phuket

Foreigners are not allowed to own landed property in Phuket. This is a truth we have to accept. A foreigner is a guest in the Kingdom of Thailand, but every foreigner can seek quality legal representation from ethical lawyers to make sure that all is done correctly, and that foreigners are adhering to either condominium laws, and/or, more importantly, land ownership laws enforced strongly by the Thai authorities. Legal advice from an experienced Thai Lawyer is essential. If any foreigners decides to purchase a property in Phuket, then they must ensure, without a shadow of a doubt, that everything is done according the laws of the kingdom.

Invest in Phuket Property From Overseas: 2025 Guide

A complete 2025 guide for overseas buyers. Discover how to invest in Phuket property from overseas, with tips on ownership, due diligence, and avoiding risks.

Phuket Property Reservation Agreements

A practical guide to Phuket property reservation agreements: understand the terms, protect your deposit, and ensure the purchase process is transparent.

Thailand Elite Visa – How to Live and Buy Property in Phuket Long-Term

Thinking of moving to Phuket? The Thailand Elite Visa offers long-term stay options for foreigners looking to buy a villa or condo in paradise. Discover the benefits, costs, and how to combine it with your dream property.

Phuket Leasehold Reciprocal Contracts

Buying a leasehold villa in Phuket? Special reciprocal contracts can help safeguard your long-term interest. This guide explains what they are — and how they fit into leasehold protection strategies.

Making a Move to Phuket? Facts Every Buyer of Phuket Property Should Know

Planning a move to Phuket? This guide covers the island’s lifestyle, culture, expat community, and what to expect when relocating — including property options and area tips.

Nominee Shareholders in Phuket – What Foreign Buyers Must Know

Some foreign buyers are advised to use Thai nominee shareholders when purchasing property — but is it legal? This article explains the risks and what to avoid.

Social Contact