SECTION 9: FOREIGN FREEHOLD CONDOMINIUMS EXPLAINED: COMPLETE GUIDE

Making the Right Choices

Foreign freehold ownership in Phuket is limited to condominiums, yet for many international buyers it remains the most transparent and secure path to ownership. Purchasing any property is a major decision, and buyers naturally seek reassurance that their investment is both legally sound and strategically secure.

In most countries, property ownership laws are straightforward. In Thailand, however, foreigners are prohibited from owning land directly, which includes villas and houses. The key exception is foreign freehold condominium ownership within registered condominium developments. These units can be purchased in a foreign buyer’s own name and registered at the local Land Department, providing clear, legally recognised title.

With accurate information, buyers can make confident decisions and avoid the misleading advice that occasionally circulates in the market. Unfortunately, some investors realise too late that they have relied on incorrect guidance or entered into ownership structures that breach Thai law.

The following section outlines the legal framework that governs foreign ownership of condominiums in Phuket, enabling investors to understand how freehold registration works and why it remains the most straightforward and compliant route to ownership in Thailand.

Current Legal Framework for Foreign Freehold Property Ownership in Phuket: Condominium Laws

Condominiums provide the clearest and most secure path to freehold ownership for foreign buyers in Phuket. Under Thailand’s Condominium Act, up to 49% of the total saleable area in any registered development may be owned by foreigners, with the remaining 51% reserved for Thai nationals.

A condominium title grants ownership of the individual unit as well as a fractional share of the common property, including shared areas such as the swimming pool, fitness facilities, landscaped gardens, parking, and reception. This title deed specifies both the size of the private unit and the percentage of the shared facilities owned, a figure that also determines an owner’s voting rights within the condominium juristic person.

The key advantage of this ownership structure is that it allows a foreign buyer to hold the property indefinitely in their own name, without lease periods or expiry. It also enables ownership to be passed on to heirs, although some inheritance procedures can be complex and require compliance with both the Condominium Act and the Civil and Commercial Code.

There can occasionally be overlap between the Condominium Act and the Thai Civil and Commercial Code (CCC) when it comes to inheritance rights for foreign condominium owners in Phuket.

Under the Condominium Act, any foreigner inheriting a unit must notify the local Land Office within sixty days. If the heir does not meet the legal criteria for foreign ownership, for example, if the 49 percent quota is already full, they may be required to sell the property within one year of the original owner’s death.

The CCC, on the other hand, recognises that ownership transfers automatically to the heir along with the estate. The Land Department generally follows this interpretation, accepting that a deceased owner’s freehold title can pass to their successor. However, the lack of extensive case law means this right is not absolutely guaranteed in every scenario, and heirs are strongly advised to seek professional legal guidance before registration or resale.

A crucial part of this process is the Foreign Exchange Transaction Form (FETF), which confirms that purchase funds were transferred into Thailand in a foreign currency. The form also acts as formal evidence that the buyer complied with Thai foreign-exchange regulations at the time of purchase. Without a correctly issued and stamped FETF, the Land Department may decline to register a freehold title or approve its subsequent transfer through inheritance, making this document essential for long-term ownership security.

The names listed on the Foreign Exchange Transaction Form (FETF) must also appear as registered co-owners on the condominium title deed. This ensures that each person named on the form holds a recognised share of ownership under Thai law. Including multiple names provides additional succession protection, as all co-owners maintain equal legal standing should the principal buyer pass away.

Properly structured co-ownership remains the simplest and most transparent succession method for foreigners holding condominiums in Phuket. By ensuring that every intended beneficiary is listed on both the FETF and the title deed, future transfers or inheritance procedures can be completed smoothly without requiring complex re-registration or the risk of title rejection. Buyers are also encouraged to retain all bank transfer documentation and Land Office receipts to support the ownership record should questions arise later.

If authorities apply a strict interpretation of the Condominium Act rather than the more flexible CCC approach, heirs may be required to transfer into Thailand an amount equivalent to the property’s purchase price before the title can be re-issued. This effectively means an heir could need to “repurchase” the condominium they have inherited, underscoring why accurate documentation and early legal advice are essential to long-term ownership security.

Further insight: The complexities of foreign freehold ownership and the Foreign Exchange Transaction process are explored in more depth by Sam Fauma (ILO Phuket), who explains the ‘Five Doors’ to lawful condominium ownership in the section below.

WHAT SAM SAYS ABOUT “THE FIVE DOORS”

WHAT SAM SAYS ABOUT “THE FIVE DOORS”

Section 19 of the Condominium Act has “Five Doors” relating to the ownership of a Phuket condominium by a foreigner. If any one of the following conditions are met, the foreigner may proceed to purchase a condo in their own name, provided not more than 49% of that development is already foreign owned.

Section 19: An alien person or a juristic person deemed alien by law may have an ownership in a unit if it satisfies the following conditions:

1: The person obtains a residence permit in accordance with immigration law;

2: The person obtains a permit to enter the country in accordance with the law on investment promotion;

3: The person is a juristic person under section 97 and section 98 of the Land Code, registered as a juristic person under Thai law.

4: The person is an alien juristic person under the Announcement of the Revolutionary Council No. 281, dated the 24th November B.E. 2515 (1972), and obtains an investment promotion certificate in accordance with the law on investment promotion.

5: The person is an alien person or a juristic person deemed alien by law, bringing foreign currency into the country, withdrawing funds from a Thai Baht account of a person having a place of residence outside of the country, or withdrawing funds from a foreign currency-based deposit account.

Number 5 is obviously the FETF, which is the most common “door” foreigners use to buy a condo, but satisfying any one of the five is enough to qualify for freehold foreign ownership of a condominium in Phuket.

Further Reading

Condominium ownership in Phuket involves more than just holding a title deed. Understanding how each development is managed, funded, and legally administered is essential for every foreign buyer or investor. Equally important is recognising the legal boundaries that govern foreign participation, including how ownership structures, quotas, and company formations must comply with Thai law. These guides cover the essential frameworks, responsibilities, and potential risks that every buyer should understand to ensure their investment remains both lawful and secure.

- Condominium Juristic Person (CJP)

- Common Area Fees (CAM Fees)

- Sinking Fund Explained

- Guide to Buying a Condo in Phuket

- Foreign Exchange Transaction Form (FETF)

- Leasehold vs Freehold Ownership

- Inheritance & Succession for Condos

- Owning a Leasehold Condominium via a Thai Company

- Nominee Shareholding Risks

Together, these resources provide a complete overview of how condominium ownership operates in Phuket, from the governing laws and financial obligations to the legal structures that make ownership secure. Understanding each of these elements ensures foreign buyers are better equipped to make confident, well-informed decisions in one of Thailand’s most dynamic property markets.

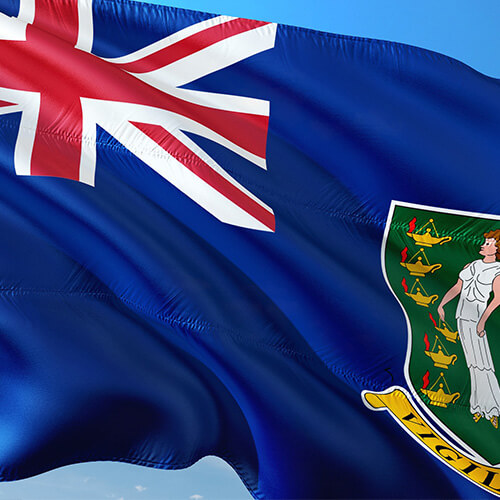

Using a British Virgin Islands (BVI) Company to Own a Property in Phuket

For many foreign buyers exploring freehold condominium ownership in Phuket, succession planning is a major consideration. One legitimate and efficient structure for long-term ownership is to hold the property through an offshore company registered outside Thailand.

While jurisdictions such as the Seychelles, Mauritius, or the Turks and Caicos Islands can be used, the British Virgin Islands (BVI) remains the most established and widely accepted option. BVI companies are internationally recognised, straightforward to administer, and have competitive annual maintenance costs, making them a practical vehicle for asset protection and inheritance planning.

This approach allows ownership to be held by a legal entity rather than an individual, ensuring continuity and simplifying succession for families or investors who wish to maintain their property interests over generations.

For many long-term investors, it also provides a straightforward structure for future resale or co-ownership arrangements, without compromising the transparency required under Thai law.

It is important to draw a clear distinction between using an offshore company to own a condominium in Phuket and using a Thai company to hold landed property, which is restricted under Thai law. The latter arrangement, sometimes used to circumvent foreign-ownership limits, is addressed separately under Phuket Villas, Houses and Landed Property. In contrast, the offshore route discussed here refers exclusively to the fully legal ownership of a registered condominium by a properly constituted foreign company.

Holding a condo through an offshore entity such as a BVI company can simplify inheritance and long-term control, as the property is owned by the company rather than an individual. Because companies do not die, the structure removes the need for probate or title transfer upon the death of the shareholder, allowing seamless continuity for future generations.

Control of the property is exercised through share ownership. The principal shareholder can transfer the condominium indirectly by selling or gifting the company’s shares instead of transferring the property title itself. This can reduce administrative complexity and, in some cases, defer certain transfer-related taxes, although professional legal and tax advice should always be sought before proceeding.

The cost of setting up and maintaining such a company varies with jurisdiction and professional fees. A typical BVI incorporation may cost several thousand U.S. dollars initially, with annual running costs of around USD 1,000-1,500. For modestly priced studio units, these expenses may outweigh the benefits; however, for higher-value condominiums, such as luxury sea-view or beachfront units, they are often regarded as a practical investment in long-term ownership security and succession planning.

There is also the question of what corporate ownership entails under Thai law. If an offshore company owns a condominium in Phuket, there are several tax and compliance obligations to consider. Although audited accounts are not a statutory requirement in the BVI, the company must still maintain financial records and, when applicable, file a balance sheet in Thailand detailing any rental income or other local financial activity.

If the foreign occupant is also a director of the offshore company, the “free rent” enjoyed through personal use of the property is considered a benefit in kind under Thai tax law. The director may therefore be required to declare this notional income and pay personal income tax based on the market rental value of the property.

Should the condominium later be sold, the BVI company is subject to corporate tax in Thailand on any capital gains arising from the sale. However, if the company structure is used purely for succession or asset-protection purposes, this liability can often be mitigated by transferring the company’s shares rather than the property title itself.

Ultimately, when the property is sold and the freehold title leaves the company’s ownership, the final shareholder remains responsible for declaring and settling any capital-gains tax due on profits accumulated since the original purchase. Maintaining clear accounting records and seeking professional legal advice in both Thailand and the offshore jurisdiction are essential to ensure full compliance and avoid unexpected tax exposure.

In summary, corporate offshore ownership can offer long-term security and smoother inheritance planning, but it also carries additional reporting and tax obligations that must be carefully managed with qualified legal guidance.

Condotels and Hotel-Licensed Condominiums in Phuket

A Condotel is a hybrid form of Phuket real estate that merges the facilities and management of a hotel with the private ownership structure of a condominium. This model, common in many global resort markets, allows individual units to be purchased outright and rented out as hotel accommodation. In short, it is designed primarily for investors rather than buyers seeking a permanent residence or private holiday home.

For those interested in foreign freehold property ownership in Phuket, Condotels offer a legally compliant and commercially attractive option. Owners can rent out their units on a daily, weekly, or monthly basis, something not typically permitted in standard condominium buildings without a hotel license. For anyone aware of the global restrictions on short-term rentals such as Airbnb, this flexibility is a major advantage.

Most Condotel developments are operated by professional hotel management companies that handle bookings, maintenance, and repairs. Owners typically receive a guaranteed number of nights for personal use each year, while the management company rents out the unit as a hotel room for the remainder of the time. Many projects also offer rental-return programs, either through a fixed guaranteed yield or a profit-sharing “rental pool,” where income is divided among participating owners.

The appeal of Condotels as a vehicle for foreign freehold ownership in Phuket is clear. Buyers can own a freehold condominium unit in perpetuity, have it professionally managed, and benefit from both the island’s property appreciation and thriving tourism sector, all while enjoying a few complimentary weeks in Phuket each year.

To operate legally as both a condominium and a hotel, a Condotel project must apply for commercial zoning and a hotel license from the outset. In theory, a condominium juristic person may allow or tolerate short-term rentals without full hotel licensing, effectively “commercialising” the building. However, for a development to be formally recognised as a hotel under Thai law, the juristic person must agree, and 100% of all unit owners must consent to converting the common area for commercial use.

Unfortunately, many Phuket condominium projects were rushed to market without considering these requirements. As a result, numerous developments advertise “guaranteed returns” based on short-term rentals despite lacking the necessary hotel license, a practice that remains technically illegal in Thailand.

There are also concerns around tax compliance within some of these schemes. While enforcement has historically been inconsistent, changes in legislation or stronger oversight could expose unlicensed short-term operations to penalties. For that reason, legally licensed Condotels stand on firmer ground and may even benefit from future regulatory tightening, as enforcement pressure pushes unlicensed operators out of the market.

For those seeking a deeper understanding of Thailand’s short-term rental landscape, see our companion article:

An Overview on the Current Situation of Short-Term Rentals in Phuket 2025

Branded Residences and Foreign Freehold Property Ownership in Phuket

Phuket’s luxury real estate market offers a unique hybrid of five-star hotel living and fully owned investment property. While some branded residences in Phuket are private villas, many are legally structured as condominiums, enabling foreign freehold ownership under Thailand’s Condominium Act.

For high-net-worth investors, the appeal is clear: ownership in a residence managed to world-class hospitality standards, often with access to a rental pool program for when the owner is not in residence. Buyers enjoy the prestige, design excellence, and professional management associated with top-tier hotel brands, while benefiting from hassle-free property maintenance.

Globally, the popularity of branded residences has surged over the last two decades. While the United States accounts for roughly one-third of all developments, there are now more than 50,000 branded residence units across over 400 projects worldwide.

The concept dates back to 1927, when the Sherry-Netherland Hotel opened on Fifth Avenue in New York. Although others followed, the sector regained momentum in the 1980s when Four Seasons launched condominiums alongside its Boston hotel. Phuket soon joined this elite market with Amanpuri, which transformed the concept through its tropical resort setting and private ownership model.

Over the past 30 years, more than 70 global hotel brands have entered the branded residence market. Interestingly, the three major boom periods, the 1920s, the 1980s, and today, all coincided with significant surges in global wealth creation.

According to UBS’s Global Wealth Report 2025, there are now over 60 million millionaires worldwide, while Forbes estimates nearly 2,800 billionaires, figures that have more than doubled in the past decade.

This rising wealth continues to fuel demand for Phuket’s branded residences. Priced above conventional condominiums, they offer exceptional value through internationally acclaimed architecture, bespoke interior finishes, and unparalleled resort amenities. The association with a luxury hotel brand not only drives premium sales prices but also ensures high rental demand at the top end of the market.

In Thailand, branded residences have proven especially popular with affluent domestic investors. In Phuket, where up to 49% of condominium units may be sold as foreign freehold, the remaining 51% is often quickly absorbed by Thai buyers. This strong dual-market demand suggests the sector will continue expanding Phuket’s portfolio of branded residence opportunities, combining luxury, prestige, and the long-term benefits of secure foreign freehold ownership.

The Amanpuri marked the beginning of Thailand’s branded residence era, redefining luxury ownership by blending world-class hotel service with private, tropical living. Its success established Phuket as one of Asia’s most desirable destinations for branded residential investment.

Today, these developments continue to evolve, offering exceptional design, privacy, and access to resort-style facilities. Their enduring appeal lies in combining the prestige of a five-star brand with the security of foreign freehold condominium ownership, creating an asset that performs equally well as a home, lifestyle retreat, or investment.

Phuket’s next generation of branded residences will further strengthen the island’s position as Southeast Asia’s benchmark for luxury freehold living, where hospitality and ownership meet in perfect balance.

Looking ahead, the continued arrival of international hotel operators and design-led luxury brands signals growing global confidence in Phuket’s real estate market. As high-net-worth buyers seek both lifestyle and long-term stability, branded residences are expected to remain one of the island’s most sought-after avenues for secure foreign freehold ownership.

Final Thoughts on Foreign Freehold Condominium Ownership

Phuket’s condominium sector offers the most transparent and legally secure path to property ownership for foreigners in Thailand. From traditional freehold condominiums to hotel-licensed Condotels and branded residences, each option caters to different priorities, whether personal use, lifestyle, or investment.

As the market continues to mature, new ownership structures and management models are constantly emerging. Understanding the legal framework behind each is essential to making informed, risk-free decisions in Thailand’s evolving real estate landscape.

The information contained in the Phuket Property Guide and all related Thai Residential articles is provided for general informational purposes only and does not constitute legal or financial advice. Property laws and regulations in Thailand are subject to change. Readers should seek independent legal counsel or official confirmation from the relevant authorities before entering into any property transaction or investment.

Social Contact