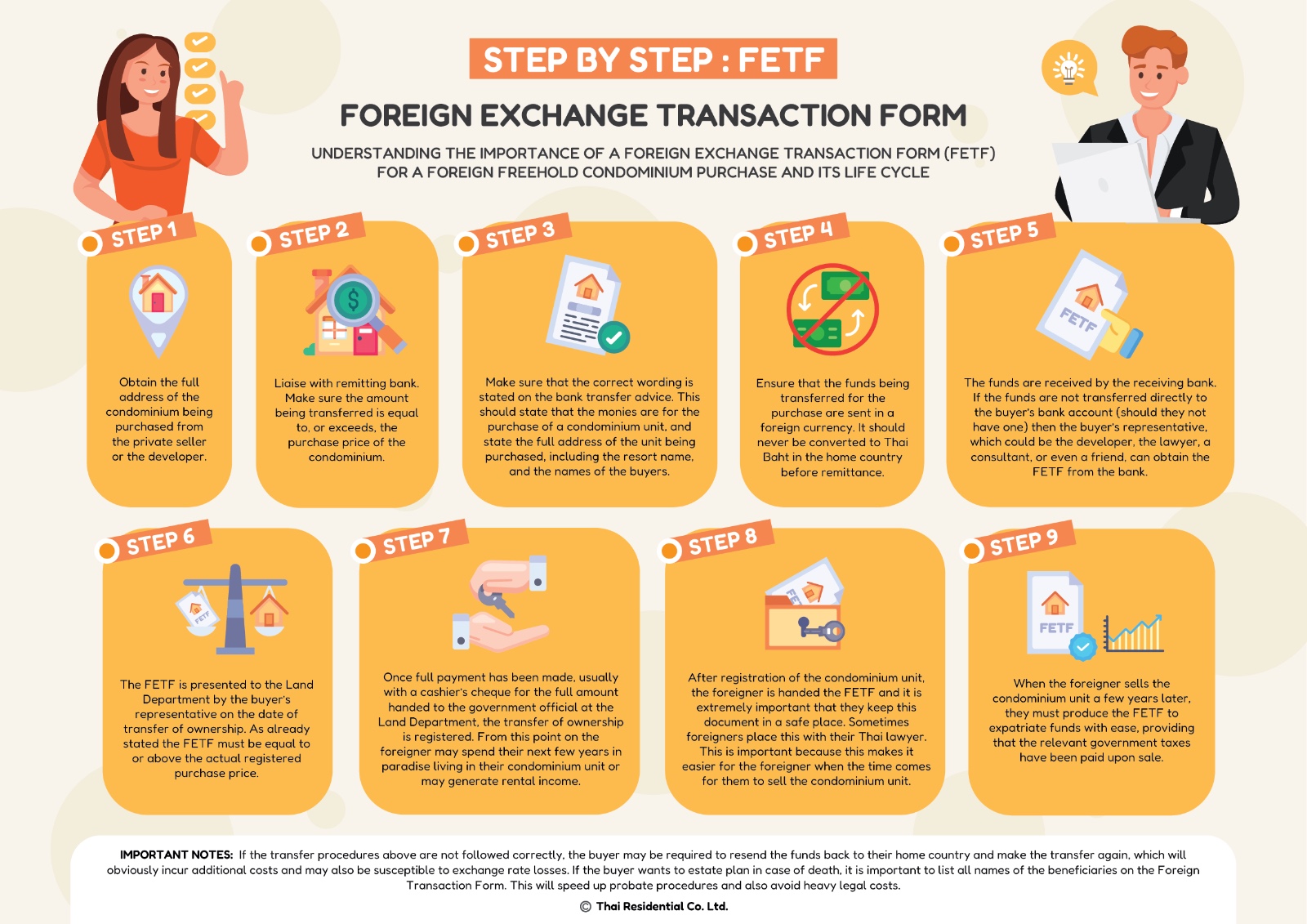

Foreigners purchasing real estate in Phuket must be aware that transferring money into Thailand requires documentation in the form of an FETF in Phuket property. This document is vital not only for registering ownership at the local Land Department but also for transferring money out of Phuket later, when selling a property.

If you’re a foreigner planning to buy a condominium in Phuket, one of the most important, and often misunderstood, documents you’ll encounter is the Foreign Exchange Transaction Form, commonly called the FETF.

This document plays a vital role in complying with Thai law when transferring ownership of a condo unit into your name. It also ensures your right to register the property as a foreign freehold. But what exactly is an FETF in Phuket property law, and why is it so essential?

What Is the FETF in Phuket Property?

The FETF in Phuket property is a certificate issued by a Thai bank confirming that foreign currency funds have been transferred into Thailand for the purpose of purchasing a condominium. It serves as official evidence that money has come from overseas, satisfying the requirements under the Condominium Act of Thailand.

Under Thai law, foreigners can own up to 49% of the total unit space in a registered condominium project, but only if the funds used to purchase the unit were remitted from abroad and properly documented with an FETF.

Why Is the FETF in Phuket Property So Important?

Without an FETF in Phuket property transactions, a foreigner cannot legally register ownership of a condo unit in their own name as a freehold.

The Land Office in Phuket will require an original FETF for any foreign buyer registering a condominium title. Without it, the transfer cannot be legally recorded, and the buyer may be forced to restructure ownership (e.g., through a leasehold) or risk non-compliance with Thai law.

When a foreigner purchases property in Thailand, particularly in Phuket, they are legally classified as an investor. This classification forms the basis for the requirement that all funds must be transferred into Thailand from overseas in foreign currency.

To ensure compliance with Thai financial regulations, the Bank of Thailand mandates official proof that these funds originated outside the country. This is where the FETF in Phuket property transactions comes in.

The FETF is issued by an authorised Thai bank once the foreign currency has been received and converted into Thai Baht for the purpose of a condominium transfer. It serves as evidence that funds have entered the Thai economy and is a critical step in registering foreign freehold ownership.

Without this documentation, ownership cannot be legally recorded under a foreigner’s name, which is why the FETF in Phuket property law is so essential.

The Five Doors to Condo Ownership

Section 19 of the Condominium Act outlines the legal avenues available to foreigners wishing to own a condo in Thailand. Among these options, transferring foreign currency into Thailand remains the most straightforward route. An FETF in Phuket property transfers is the document that makes this possible.

A common mistake is sending Thai Baht directly into a Thai bank account or transferring funds in the wrong currency before securing a property. Without an FETF, freehold registration will not be possible. To qualify, funds must be sent from abroad in foreign currency, with the purpose of purchase clearly stated.

When and How Do You Obtain the FETF?

The FETF is not applied for directly. Instead, the receiving bank in Thailand issues it automatically when a transfer of USD 50,000 (or equivalent) or more in foreign currency is received, with the purpose clearly noted (e.g. “for condominium purchase in Phuket”).

The Thai bank will convert the funds into baht and issue the FETF, which must include:

-

Name of the sender

-

Name of the recipient (developer, seller, or lawyer)

-

Purpose of remittance (property transfer)

-

Amount in both foreign currency and Thai Baht

For smaller transactions under USD 50,000, a “Credit Advice” may be issued. While not technically an FETF, this can still be accepted at the Land Office if it contains the required details.

Common Mistakes to Avoid

-

Never send Thai Baht directly from overseas – the funds must be foreign currency

-

Never transfer funds in someone else’s name

-

Avoid breaking up transfers into amounts under USD 50,000 unless unavoidable

-

Always state the reason for transfer clearly (e.g. “purchase of condominium in Phuket”)

Following these steps is essential for ensuring that the bank can issue the correct FETF in Phuket property transactions without delays or rejections.

How to Get the FETF from the Bank

Many foreigners do not have a Thai bank account. In such cases, funds are often remitted to a lawyer’s client account or directly to a developer. The authorised bank receiving the transfer will then issue the FETF on behalf of the foreign client.

What Happens to the FETF After Transfer?

The FETF in Phuket property transactions must be presented at the Land Office during transfer of ownership. Lawyers or agents typically include it in the ownership documents.

It is advisable to keep a copy for personal records, especially for future resale or repatriation of funds abroad. Thai authorities may request the original FETF as proof of the initial transfer.

Summary: Key Facts About the FETF in Phuket Property

-

Required for foreign freehold condo registrations

-

Issued by a Thai bank for foreign currency transfers over USD 50,000

-

Essential for registering a condo in a foreigner’s name

-

Cannot be issued for domestic Baht transfers

-

Ensures compliance with the Condominium Act

In Summary

The FETF in Phuket property is a legal safeguard that ensures funds for condominium ownership are remitted properly from abroad. By working with banks, lawyers, and advisors who understand the requirements, foreigners can avoid unnecessary complications and ensure compliance with Thai law.

Related Guides

Disclaimer: The information contained in this article is provided for general informational purposes only and does not constitute legal, financial, or investment advice. While every effort has been made to ensure accuracy at the time of publication, property laws and regulations in Thailand are subject to change. Readers should always seek independent legal advice from a qualified Thai lawyer before making any property-related decision or transaction.

Social Contact