Transferring Ownership of Property? Phuket Transfer Documents Needed

When completing a transfer of ownership at the Phuket Land Department, there are specific documents that must be presented to the government official. This guide explains what property ownership transfer documents in Phuket are required at the Land Office.

The procedures at the Land Office are relatively straightforward. Typically, once both parties have agreed on terms, a Reservation Agreement is drafted, usually by the seller’s lawyer.

After a deposit has been paid and receipted by the seller (or the seller’s lawyer or a developer), the legal representatives work together to finalise and agree upon all terms of the transaction in a Sale and Purchase Agreement (SPA).

Transferring ownership of a property in Phuket is a legal milestone that must be handled with care. Whether it involves a villa, a condominium, or even a plot of land, the transfer process at the local Land Office requires documentation, payment of fees, and strict compliance with regulations.

Here’s a complete breakdown of the paperwork required for a smooth ownership transfer, including important considerations for foreigners, and what to expect on the day.

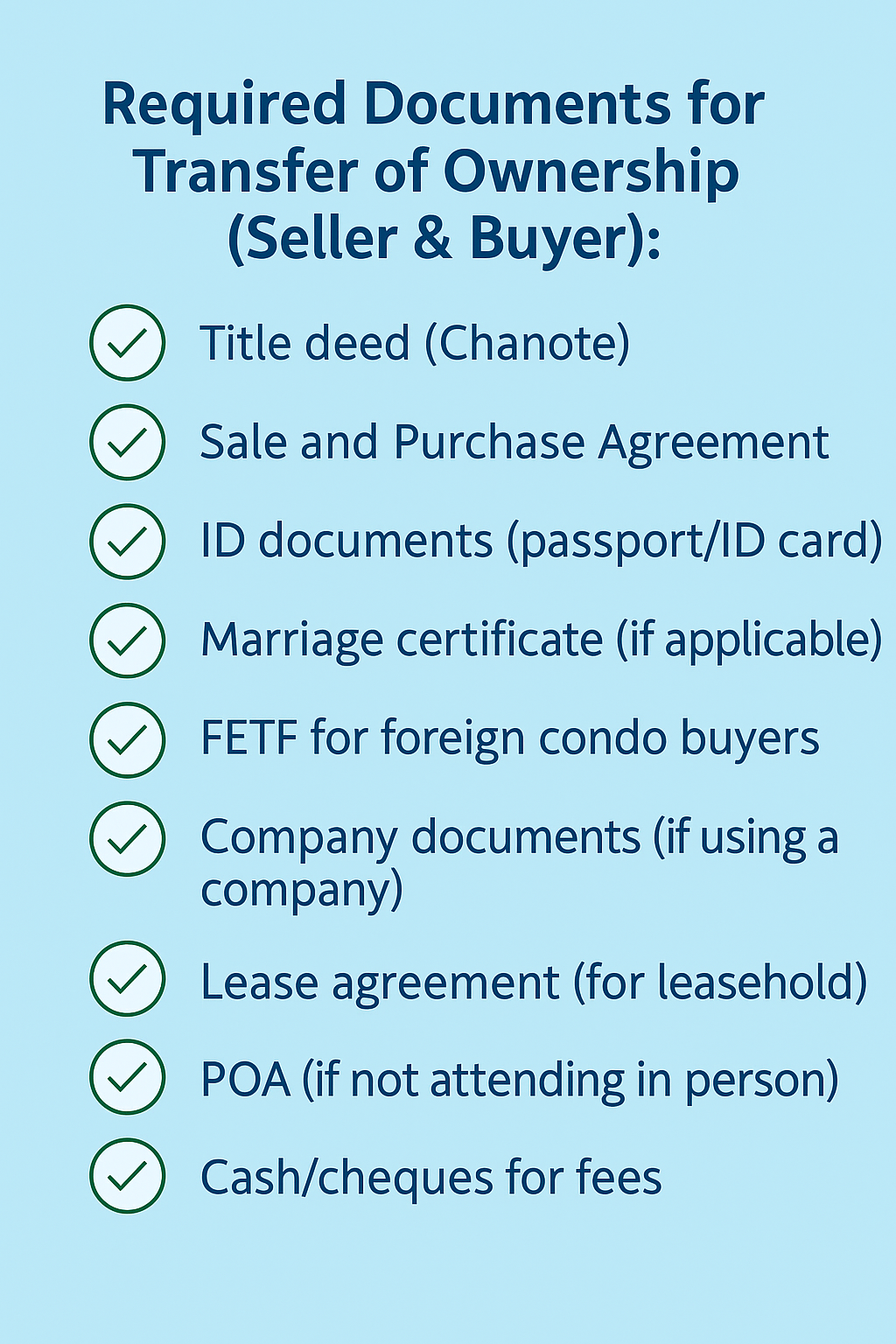

Required Property Ownership Transfer Documents in Phuket (Transferor & Transferee)

For the Transferor:

-

Original Title Deed (Chanote) – This must be presented in original form and shows the legal owner.

-

House Registration Book (Tabien Baan) – For standalone properties (not required for condos).

-

ID Card or Passport – If Thai, a valid Thai ID card; if foreigner, a valid passport.

-

Marriage Certificate – If the seller is married (Thai or foreign), this may be needed for joint signatures.

-

Spouse Consent Form – If the property is in one spouse’s name but purchased during marriage, consent is often required.

-

Power of Attorney (if not present in person) – If the seller cannot attend, a POA must be prepared on a Land Office form and signed in front of a notary or Thai embassy abroad.

For the Transferee:

-

ID Card or Passport

-

Marriage Certificate (if applicable)

-

Foreign Exchange Transaction Form (FETF) – If a foreigner is buying a condominium in freehold, funds must be remitted from overseas in foreign currency and converted in Thailand. The receiving bank will issue this form for transfers exceeding USD $50,000.

-

Power of Attorney (if applicable) – Same as for the seller.

Additional Documents for Foreign Condominium Purchases

For freehold condominiums in Thailand, foreigners must submit:

-

Proof of Foreign Currency Transfer (FETF)

-

Declaration of Unit Quota – To prove that foreign ownership in the building does not exceed 49%

-

Sale and Purchase Agreement – Often required by the Land Office to verify agreed terms

-

Developer’s Documents – For new builds, the developer typically assists with all paperwork and compliance, but the buyer must still ensure all property ownership transfer documents in Phuket are properly submitted

For a full overview of how direct ownership works, see our guide on foreign freehold condos in Phuket, which explains the process and protections available to foreign buyers.

Additional Notes for Villas and Land Purchases

For villas and land, especially when foreign ownership structures are involved:

-

Lease Agreement – If ownership is via leasehold, the lease agreement must be registered with the Land Office (often a 30-year lease, renewable).

-

Company Documents – If purchasing through a Thai company, you will need:

-

Company Affidavit

-

Shareholder List (updated)

-

Memorandum of Association

-

Company Registration Certificate

-

Minutes of Meeting authorising purchase

-

Tax ID card of the company

-

-

Land Due Diligence – Ensure the land has the correct zoning, no encumbrances, and that building permits are valid if the transfer involves existing structures.

Phuket Property Transfer Documents: The Day of Transfer

Transfers take place at the Phuket Land Office, usually in Phuket Town. Both buyer and seller (or their appointed representatives) must attend with all original documents.

Here’s what typically happens:

-

Verification of Documents by Land Office staff

-

Calculation and Payment of Transfer Fees (usually split between buyer and seller, unless stated otherwise)

-

Signing of Transfer Documents

-

New Ownership Registered – The Land Office issues a new title deed in the buyer’s name (or registers the lease), once all property ownership transfer documents in Phuket have been reviewed and accepted.

Government Fees & Taxes (Rough Guide)

At the time of transfer, the following fees and taxes are typically assessed by the Land Office. The exact amounts are based on either the registered sale price or the government’s appraised value, whichever is higher:

| Fee/Tax | Amount |

|---|---|

| Transfer Fee | 2% of registered value |

| Stamp Duty | 0.5% (if no Specific Business Tax) |

| Specific Business Tax (SBT) | 3.3% (if property sold within 5 years) |

| Withholding Tax (Seller) | 1% for companies; sliding scale for individuals |

Note: How these costs are divided should be clearly defined in the contract to avoid disputes.For further details on how fees and ownership transfers are administered, see the official guidance from the Department of Lands, which provides official information on regulations and procedures.

Tips for Handling Property Transfer Documents in Phuket

-

Engage a Reputable Lawyer – Local expertise helps ensure compliance with Thai law and prevents administrative mistakes.

-

Prepare Funds in Advance – Fees and taxes must usually be settled at the Land Office by cash or bank cheque.

-

Double-Check Names and Details – All names on identification documents and the title deed must match exactly.

-

Confirm Freehold vs Leasehold Early – The required documentation differs significantly depending on the ownership structure.

-

Clarify Responsibilities in the Contract – Clearly outline how fees and taxes will be divided between the parties.

Summary: Phuket Property Transfer Documents

Having the correct Phuket property transfer documents is essential for a smooth process at the Land Office. Whether it involves a condominium, villa, or land, both parties must provide the right paperwork, meet legal requirements, and ensure fees are settled correctly. Careful preparation helps avoid unnecessary delays and ensures the new ownership is registered without complications.

Related Guides

Conclusion

Having the correct Phuket property transfer documents in place is essential for a smooth and legally compliant transfer of ownership. Careful preparation and professional guidance ensure that the process is straightforward and free of unnecessary delays.

Disclaimer: The information contained in this article is provided for general informational purposes only and does not constitute legal, financial, or investment advice. While every effort has been made to ensure accuracy at the time of publication, property laws and regulations in Thailand are subject to change. Readers should always seek independent legal advice from a qualified Thai lawyer before making any property-related decision or transaction.

Social Contact