SECTION 14: TRANSFERRING MONEY INTO PHUKET

Find your new Phuket Property with Thai Residential

Transferring Money into Phuket

Any foreigner planning to purchase a property in Phuket must follow the correct procedures for transferring money into Thailand. If the proper steps are not taken it may prove impossible to repatriate the money when it comes time to sell your Phuket property, and for it to leave Thailand.

If more than US$ 50,000 is being remitted for the purchase of a Phuket condominium, a Foreign Exchange Transaction Form (FETF) must be requested from the receiving bank.

If funds are being remitted for the purchase of a villa, for a long term lease on a property, or to provide share capital for a Thai company, the FETF is not a statutory requirement. As long as all evidence of the original transaction can be presented and is clear, and there is proof that all requisite taxes have paid, the funds can be sent out of Thailand at a later date.

This process does take longer than it would with an FETF, so even if you are buying a villa in Phuket, it may be worth requesting one from your receiving bank/developer even though it is not required.

The FETF Required for a Phuket Condo Purchase

The Condominium Act states that any non-resident of Thailand who wishes to buy a condominium, must transfer the requisite funds from overseas specifically for that purpose. Regardless of the buyer’s country of origin, the funds must be sent in a foreign currency, to be converted into Thai Baht (THB) by the receiving bank upon arrival in the country.

In order to register a new condominium purchase with the Phuket Land Department, the FETF documentation must be presented to prove that the full purchase price was transferred into the Kingdom from abroad. (The instruction on the bank transaction form should also state that the payment is for the sole purpose of purchasing a condominium.) From an estate planning perspective, it is a good idea to always have multiple names (including children or grandchildren) added to the original telegraphic transfer, so they may be included on the FETF.

If the only way to arrange payment is by transferring funds to the developer directly, then the developer must arrange the FETF forms on behalf of the foreign buyer.

Taking the money out of Phuket at a later date is relatively straight forward, provided all the supporting documents can be presented. This is especially important if the funds have been borrowed from an overseas financial institution and/or there is an overseas mortgage on the condo.

Please also note that no repatriation of money will be possible until any income/capital gains taxes have been settled on the sale of the condominium. The FETF must also be presented to the tax authorities as proof of the legitimate ownership.

Whether ultimately remitting the funds back to a private account, or to repay a bank loan, the Foreign Exchange Transaction Form is an absolute requirement. By ensuring multiple names are on the FETF, not only is inheritance made easier, but funds can also be returned to the account of an heir. This document should be kept in a safe place at all times.

Again, it is wise to consult a good Thai lawyer throughout this process.

Buying and Leasing Property in Phuket Articles

Katamanda Resort: One of Phuket’s Most Prestigious Hillside Communities

Nestled in the lush hills between Kata and Kata Noi beaches, Katamanda Resort is an exclusive gated community of private villas offering a perfect blend of tropical charm and modern luxury. With sweeping sea views, spacious layouts, and resort-style facilities, Katamanda is ideal for discerning buyers seeking privacy, tranquility, and proximity to some of Phuket’s most beautiful beaches. Whether for a full-time residence, holiday home, or investment property, Katamanda delivers timeless elegance in one of the island’s most prestigious enclaves.

Phuket’s Most Breathtaking Views: And the Areas Nearby to Buy a Villa or a Condo

From iconic lookouts like Big Buddha and Promthep Cape to the hillside bars of Kata Noi, explore Phuket’s top viewpoints - and the best nearby places to buy a sea view villa or condo.

Nai Harn Villas with Lush Gardens: A Wildlife Haven for Birds, Butterflies & Nature Lovers

Discover the charm of owning a villa in Nai Harn or Rawai with a vibrant tropical garden that attracts birds, butterflies, and nesting wildlife. A nature lover’s paradise in Phuket’s most peaceful area.

Why Nai Harn Is Phuket’s Best Area for Villa Buyers in 2025

Nai Harn is quickly becoming Phuket’s top destination for villa buyers. With better prices, stunning scenery, and a strong community feel, it’s the ideal place to find your dream home or investment in 2025.

The Title Projects in Phuket: Rawai, Nai Harn & Kata Beginnings to Bang Tao Expansion

Explore the full collection of “The Title” condominium and villa developments across Phuket by Rhom Bho Property PLC, including Rawai, Nai Harn, Kata, Naiyang, and Bang Tao. From stylish resort-style condos to luxury private pool villas, The Title projects offer exceptional value, amenities, and long-term investment appeal for property buyers in Thailand.

Living Close to Nature in Rawai & Nai Harn, Phuket’s South

Rawai and Nai Harn showcase the best of nature in Phuket’s south. With beaches, green hills, and a vibrant community, villas and condos here offer a lifestyle close to nature.

Phuket Property Ownership Costs in 2025: Homes, Villas & Living Expenses

Discover the true cost of owning property in Phuket in 2025 — from utilities and maintenance to insurance, taxes, and property management fees. A must-read for serious buyers and investors.

The Transformation of Andaman Cove Condominium, Rawai: A New Era Begins

Once part of the famous Evason Resort, Andaman Cove Condominium in Rawai is finally being transformed. After years of decline, the site has been acquired by luxury hotel developer YTL Group. This marks a turning point for owners, with the promise of rising property values, improved surroundings, and renewed access to Bon Island—all just minutes from Nai Harn and Phuket’s southern beaches.

Best Villas in Rawai & Nai Harn – Phuket’s South

Rawai and Nai Harn in Phuket’s south offer some of the island’s best villas. From hillside pool villas to modern estates, here’s why this area is so popular with lifestyle buyers and investors.

Phuket Leasehold Property Guide

A clear guide to Phuket leasehold property, covering how leasehold works, its limitations, and what foreign buyers need to know in 2025.

Thailand’s Cannabis U-Turn and Its Ripple Effect on Phuket’s Property and Real Estate Market

Thailand’s cannabis U-turn in 2025 is reshaping Phuket’s property market. From fading dispensaries to shifting buyer interest, here’s how the crackdown is creating both risk and opportunity for investors and developers.

How to Avoid Overpaying for a Condo in Phuket: A Smart Buyer’s Guide

Avoid overpaying when buying a condo in Phuket. This guide covers market pricing, valuation tips, and how to spot overpriced listings before you invest.

Phuket Condominium Juristic Person (CJP): What Owners Should Know

If you own or are planning to buy a condo in Phuket, understanding how the Condominium Juristic Person (CJP) manages the building is essential. Here's what you need to know.

Land Titles in Phuket – What Buyers Should Know

Before buying land or property in Phuket, it's essential to understand land titles. Here's what buyers should know about Chanote, Nor Sor 3, and Nor Sor 3 Gor titles—and why due diligence is critical.

Minor International & Kiara Reserve Residences: Luxury Villas & Condos at Layan Bay, Phuket

Minor International & Kiara Reserve Residences – Branded Luxury Villas & Condos in Layan Bay, Phuket Kiara Reserve is a prestigious residential estate developed by Minor International in partnership with Kajima, set amidst the tropical beauty of Phuket’s Layan Bay. Offering a collection of 17 luxury pool villas and 29 branded condominiums, each residence is meticulously designed and managed by Minor Hotels for seamless full-service living. With its tranquil beachfront location, exceptional build quality, and the credibility of billionaire Bill Heinecke’s Minor International, Kiara Reserve delivers an unrivalled combination of elegance, exclusivity, and long-term investment appeal.

Tri Vananda Villas: A Wellness-Centered Sanctuary in Pru Champa, Phuket

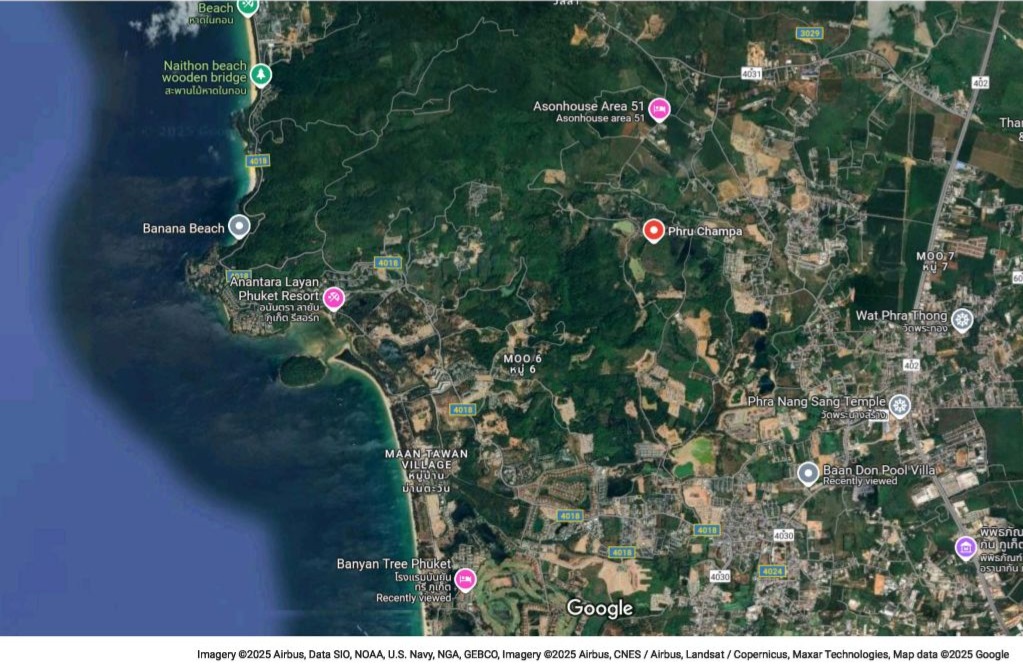

Tri Vananda Villas is a visionary wellness community in Phuket’s peaceful Pru Champa area, offering luxury pool villas designed for natural living and holistic health. With only 77 private villas surrounded by wetlands, gardens, and lakes, the estate features biophilic architecture, integrative medical and spa facilities, and a Michelin-starred restaurant. Just minutes from Laguna, UWC, and Phuket International Airport, Tri Vananda is ideal for families, retirees, and investors seeking sustainable, wellness-focused living in one of Phuket’s fastest-emerging residential zones.

How to Avoid Common Property Scams in Phuket

Phuket’s booming real estate market has become a magnet for international investors — but where there’s opportunity, scams often follow. From fake land titles to off-plan development frauds, this guide exposes the most common property scams in Phuket and how to avoid them. With the right legal support and a cautious approach, you can confidently invest in your dream home or rental property without falling victim to costly mistakes.

Why Phuket Is Still a Great Place to Live in the Rainy Season

Don’t let the weather stop you — this is one of the best times to explore the island’s lush landscapes, cultural gems, wellness retreats, and indoor adventures without the crowds. From cozy cafés and cooking classes to misty temples and roaring waterfalls, the green season offers a quieter, more authentic side of Phuket that many travelers never get to see.

Rungtiva Villas: Modern Tropical Villas in the Heart of Pru Champa, Phuket

Rungtiva Villas is a boutique collection of modern pool villas nestled in the peaceful Pru Champa area of central Phuket. Surrounded by nature yet close to top schools, golf courses, and both east and west coast attractions, these spacious 3 and 4 bedroom homes offer exceptional value for families, retirees, and investors alike. With a focus on privacy, quality, and livable design, Rungtiva Villas is the ideal choice for those seeking a quiet lifestyle in one of Phuket’s most convenient and up-and-coming residential areas.

Phuket Living in 2025: Dos and Don’ts for New Property Owners

Dreaming of island life in Phuket? Whether you're planning a long-term move or have already unpacked your bags, living in Thailand’s tropical haven requires more than sunscreen and a hammock. From choosing the right neighborhood and budgeting realistically to navigating visa laws and embracing Thai culture, this guide outlines the key do’s and don’ts for making expat life in Phuket smooth, safe, and deeply rewarding. If you're relocating in 2025, consider this your essential handbook for thriving on the island.

What You’ll Need After Buying a Home in Phuket: A New Homeowner’s Checklist

Thinking of buying a home in Phuket? This 2025 checklist breaks down the essentials every new property owner needs — from furnishings and utilities to internet and safety gear.

Lucky Villas Phase 2: Contemporary Tropical Living in Phuket

Discover contemporary tropical living at Lucky Villas Phase II, a boutique development of modern pool villas near Layan Beach and the Laguna Phuket resort complex. Nestled in a peaceful residential enclave in the northeast of Cherng Talay, these stylish 3- and 4-bedroom villas are designed for privacy, comfort, and easy island living. With close proximity to international schools, golf courses, shopping, and Bang Tao’s vibrant beach scene, Lucky Villas Phase II offers a rare blend of tranquility and convenience, perfect for families, retirees, or investors seeking strong rental potential in one of Phuket’s most sought-after locations.

Pru Jampa: Phuket’s Next Residential Hotspot

Pru Jampa is quickly becoming one of Phuket’s most desirable addresses, thanks to a growing collection of luxury villa projects that blend contemporary design with natural serenity. Surrounded by lush greenery yet just minutes from beaches, international schools, and lifestyle hubs, the area is home to some of the island’s most exciting new developments. From award-winning builders like Botanica, Erawana, and Anchan, each project offers privacy, quality, and strong investment potential — making Phu Champa the smart choice for buyers seeking peace without compromise.

Erawana Creek: Tropical Serenity in the Heart of Pru Jampa, Phuket

Erawana Creek - Boutique Tropical Pool Villas in Pru Jampa. Discover the tranquility of Pru Jampa at Erawana Creek, a beautifully designed enclave of private pool villas by the respected Erawana Group. Each villa blends modern tropical architecture with seamless indoor‑outdoor living, featuring natural light, spacious terraces, and lush garden surrounds. Located minutes from Bang Tao and Layan beaches, and just a short drive to lifestyle hubs like Boat Avenue, this intimate development offers serenity without sacrificing convenience, an ideal choice for discerning buyers seeking privacy, quality, and a rare sense of retreat in Phuket.

Erawana Grand: Elegant Ayutthaya‑Style Villas in Prime Layan

Erawana Grand – Ayutthaya-Inspired Luxury Villas in Layan. This exclusive collection of just nine ultra-luxurious 4-bedroom pool villas set in the peaceful and upscale enclave of Layan, Phuket. Designed with a distinctive Ayutthaya-style influence, each villa features soaring ceilings, handcrafted woodwork, and seamless indoor-outdoor living. With generous land plots, lush tropical landscaping, and a prime location just minutes from Bang Tao Beach, Laguna, and the airport, Erawana Grand offers the perfect blend of privacy, elegance, and convenience — making it one of Phuket’s most refined residential offerings.

Social Contact