SECTION 8: BUYING A FOREIGN FREEHOLD CONDOMINIUM IN PHUKET

Making the Right Choices

Investing in property is always a big decision. Buyers want to have the confidence that their real estate investment is a well-considered and safe choice.

The laws in many countries make property ownership pretty straightforward, but in Phuket foreigners are not allowed to own land, and this restriction extends to landed property such as villas and houses. A foreign buyer may, however, buy freehold condominiums, which can be registered in their own name at the local Land Department.

Equipped with the right information, foreign buyers can make informed decisions. They can also use that information to deflect the inaccurate statements and questionable advice that sometimes comes from agents or developers. In many cases, buyers do not find out that they have made poor investment decisions – or even that they have flouted Thai Laws – until it is too late.

In the following two sections, we aim to cover every aspect of the laws governing property ownership, and is intended to help those discerning investors who are looking to invest in the Phuket property market to make intelligent and educated decisions. The next two sections cover the various ways for foreigners to own a Phuket villa, either with a leasehold contract and/or obtaining freehold ownership through a Thai Company Limited.

Let’s start with foreign freehold condos!

Phuket Condominium Laws

Freehold condo ownership is fairly clear-cut, and is the best way for foreigners to own property in Phuket. Thai law states that a condominium complex may have up to 49% foreign ownership, meaning at least 51% of any complex must be owned by Thai nationals.

A condominium title includes part of the building, meaning every owner has a “fractional interest” in the building. This includes the common area such as the swimming pool, gymnasium, gardens, car park and the reception area. A condominium title should specify not only the size of the unit itself, but also the total common area (and what percentage is owned by each condominium unit). For foreign freehold condo owners in Phuket, that fractional interest also represents the voting interest the owner will hold within the residents or owners association.

One of the many benefits and advantages of a freehold condominium is that it can be fully and legally owned by a foreigner. The condo ownership is permanent and in perpetuity until the owner decides to sell it.

Another benefit of a Phuket freehold condominium is the favourable legislation governing inheritance, i.e. foreigners are able to pass their Thai condominium on to their heirs. But while the inheritance laws are more beneficial than those for leasehold villas, they are neither perfect, nor perfectly clear.

There is competing legislation at work here. The Condominium Act states that any foreigner who inherits a condominium must notify the relevant Land Office within 60 days of the inheritance. Failing to meet specific criteria for ownership, the foreign heir may then be compelled to sell the unit within 1 year of the death of the owner.

The Thai Civil and Commercial Code (CCC), however, indicates that the inheritor of the property would also inherit the right to own the property, and this has been the formal legal opinion of the Land Department – that the right of the deceased owner to acquire property and retain ownership passes to his/her heir upon death.

But the Land Department’s interpretation of inheritance law under the CCC is not yet backed by sufficient case law for an heir to be 100% certain of receiving permanent ownership rights. One of the five requirements for condo ownership stipulated by the Condominium Act is a Foreign Exchange Transaction Form (FETF) issued in the name of the condo owner.

One way to make any future inheritance easier is for the buyer to have their overseas bank put multiple names on the telegraphic transfer instruction when wiring the money to Phuket for the property purchase. The Thai receiving bank will then be able to list all of those names on the FETF.

The names on the FETF must then be recorded as co-owners of the condo, which secures inheritance in the event of the death of the principal buyer of the property. (Making an offshore company the registered owner of the property is another way to ensure an easier succession, as the FETF will be in the company name.)

However, if a strict interpretation of the Condominium Act is applied to an inheritance— rather than the more favourable CCC interpretation — things get a little more complicated. Anyone who inherits a property (should they choose to keep it) may be required to transfer into Thailand the amount necessary to buy the unit. It may sound counter intuitive, but it is possible that someone must effectively buy the very condo they have just inherited. FETF requirements will be discussed in greater depth, but for more information about the five requirements (or “Doors”) to foreign ownership of a condo in Phuket see below from Sam Fauma of ILO.

If you are seriously thinking of buying a condominium in Phuket, then you may want to read our comprehensive guide on how to do things correctly and what to expect throughout the entire process:

WHAT SAM SAYS ABOUT “THE FIVE DOORS”

WHAT SAM SAYS ABOUT “THE FIVE DOORS”

Section 19 of the Condominium Act has “Five Doors” relating to the ownership of a Phuket condominium by a foreigner. If any one of the following conditions are met, the foreigner may proceed to purchase a condo in their own name, provided not more than 49% of that development is already foreign owned.

Section 19: An alien person or a juristic person deemed alien by law may have an ownership in a unit if it satisfies the following conditions:

1: The person obtains a residence permit in accordance with immigration law;

2: The person obtains a permit to enter the country in accordance with the law on investment promotion;

3: The person is a juristic person under section 97 and section 98 of the Land Code, registered as a juristic person under Thai law.

4: The person is an alien juristic person under the Announcement of the Revolutionary Council No. 281, dated the 24th November B.E. 2515 (1972), and obtains an investment promotion certificate in accordance with the law on investment promotion.

5: The person is an alien person or a juristic person deemed alien by law, bringing foreign currency into the country, withdrawing funds from a Thai Baht account of a person having a place of residence outside of the country, or withdrawing funds from a foreign currency-based deposit account.

Number 5 is obviously the FETF, which is the most common “door” foreigners use to buy a condo, but satisfying any one of the five is enough to qualify for freehold foreign ownership of a condominium in Phuket.

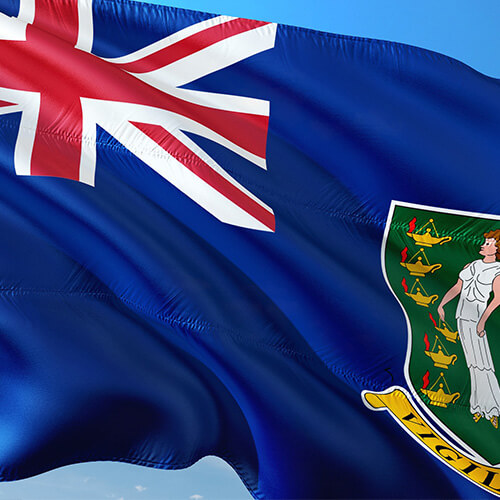

Using a British Virgin Islands (BVI) Company to Purchase a Property in Phuket

For any foreigner concerned with succession planning, it may be worthwhile buying a condominium (or villa) through an offshore company. This could be a company registered in the Seychelles, Mauritius, Turks and Caicos or other offshore jurisdiction, but BVI companies are generally preferred as property holding companies because they are one of the most established offshore centres, and have competitive annual running costs.

It is important to draw a distinction between using an offshore company to buy a condominium in Phuket, and using a Thai company to circumvent landed property ownership rules. (The latter practice is discussed in greater detail under “Phuket Villas, Houses and Landed Property”). Here we are referring to the legal purchase of a freehold condominium, not by a foreign individual, but by a foreign company. Offshore company ownership solves the inheritance issue because companies do not die.

Through a BVI company, the foreigner can control the ownership of the condo by controlling the shareholding of the company. In addition, should they wish to sell the condo, they need only to sell the BVI company. By transferring the company share ownership, the new buyer owns the company and the condo, but this may not be cost effective with lower-priced condos.

To begin with, establishing a BVI company costs a few thousand dollars. After that, the annual running costs are a little over $1,000 per year. For a $100,000 studio condo, this may be more than someone is willing to pay. For an $800,000 sea view Phuket penthouse, however, it may be a no-brainer.

There is also the question of what corporate ownership entails under Thai law. If an offshore company owns the property, there are potential tax consequences. Even though audited accounts are not a statutory requirement in the BVI, the company must file a balance sheet in Thailand detailing the rental income. Furthermore, if the foreign occupant is a director of the offshore company, their “free rent” is deemed to be a benefit in kind from the company. The individual must then pay income tax on the fair market value of the annual rent.

Finally, if the condo is sold, the BVI company must pay corporate tax in Thailand on any capital gain. If the purpose of the company is ease of inheritance, this last one can obviously be avoided by transferring ownership of the company.

When the property is ultimately sold, however many years in the future that maybe, the freehold title will be transferred away from the BVI company. When that happens, the ultimate seller (the final owner of the company) will have to pay income tax based on the total capital gains earned on the property.

Condotels and Hotel-Licensed Condominiums in Phuket

A Condotel is a hybrid species of Phuket real estate combining the services of a hotel and a condominium. It is a common concept in other parts of the world, which permits individual units to be privately purchased, and then rented as hotel accommodation. In short, this type of ownership is for anyone purely interested in investment, not for someone seeking a second home.

The owner of a Condotel unit may rent it out on a monthly, weekly, or even daily basis. (For anyone who has followed the restrictions being placed on Airbnb by cities and countries around the world, this is a huge advantage for any property investor.)

A hotel management company is typically employed to run the resort, and these companies all have attractive rental programs.

The owner is usually allocated a fixed number of days per year to use their unit, but for the remainder of the time the management company treats the unit as a normal hotel room. Under most arrangements, they also take care of maintenance and repairs to the unit.

Most Phuket Condos set up with hotel licenses offer either a guaranteed return or the option to enter into a “rental pool,” which requires the owner to make their unit available for rental (together with the other participating owners). The owners then “pool” the rental income, and share together in the profits.

The attraction of a Condotel investment for a foreigner is obvious. Firstly, they are permitted to own a Phuket freehold condominium unit in perpetuity. Secondly, they are legally allowed to have the rental of their unit managed for them by a professional hotel management company. They can therefore take advantage of Thailand’s flourishing real estate sector, while simultaneously capitalising on Phuket’s booming tourism industry. At the same time, they can also enjoy “free” accommodation in Phuket fora few weeks every year.

To function effectively as a condo, as well as a hotel, a Condotel development should apply for commercial use on day one. It is theoretically possible for the juristic person at a condominium to allow (or at least condone) short-term rentals, effectively “commercialising” the condo for use as a Condotel. If the juristic person chooses to allow this, the agreement of the owners is not required. But to apply for the hotel license, thus officially making the development into a Condotel, not only must the juristic person agree, but this legal commercialisation of the common area also requires the assent of 100% of the owners.

It is unfortunate that many Phuket condominium projects were rushed into development without first contemplating their use as a hotel. Shorter-term rentals (e.g. daily and weekly) are technically illegal in Thailand without a hotel license, yet many condominium developments offer guaranteed returns based largely on the short-term rental market.

It is also possible that many of the people profiting from short-term rentals are not paying tax on their income. Anyone who gets to know Thailand soon understands that nothing is a problem until lawmakers decide to take action. In other words, everything is OK . . . until it isn’t.

If Phuket should experience a slowdown in tourism, hoteliers may campaign in strength for an end to illegal short-term rentals. Any development already run with a hotel license would of course be immune from the potential backlash. So if hoteliers were successful in any such campaign against short-term rentals, Condotels would profit right along with them.

You can read more about the situation with short term rentals in our article on the subject here:

An Overview on the Current Situation of Short-Term Rentals in Phuket 2020

Phuket’s Branded Residences

Phuket’s luxury real estate sector also offers a hybrid hotel/investment property which can be owned freehold by foreigners. While some branded residences in Phuket are villas, many developments are legally structured as condominiums.

The appeal of branded residences for high net worth individuals is obvious. Investors get to buy into the quality and high levels of service which are synonymous with upscale 5-star hotel chains. They also get to have the property resort managed for them, including a rental pool if they are not living on site.

This attraction has seen the popularity of these units expand significantly over the last two decades. While the USA has around one-third of the world’s total, the global market now has more than 50,000 units of branded residences worldwide, spanning 400 different developments.

The origins of Branded Residences date back to 1927 when the Sherry-Netherland Hotel opened on Fifth Avenue, at the southeast corner of New York’s Central Park. While other branded residences followed, the sector did not really become popular again until the 1980s when Four Seasons launched condominiums attached to their hotel in Boston.

The first branded residence in Phuket followed shortly thereafter with the Amanpuri in Phuket, which revolutionised the concept with its resort setting.

In the last 30 years, the sector has gone from strength to strength. Today there are over 70 hotel groups which have entered the sector.

It is not a coincidence that the decade which saw the creation of branded residences (the 1920s), and the periods which saw an expansion in the market for luxury hotel-branded accommodation (the 1980s and present day), were all times of significant wealth creation.

According to UBS’s Global Wealth Report 2024, there are 58 million millionaires in the world, while Forbes magazine places the number of billionaires at nearly 2,800. And in the last decade, the numbers of millionaires and billionaires in the world have more than doubled.

This shifting demographic is good news for branded residences, as their prices tend to be a few notches above traditional condominiums. But for that money, buyers know they can expect exquisite designs, often from world-renowned architects, as well as luxury interiors with the highest quality fixtures. In Phuket, they can also expect resort settings with magnificent landscaping, and wonderful views.

The quality standards that accompany a luxury hotel name not only ensure that the condominiums sell for premium prices, but also that they are in high demand as rental properties, and command premium rental prices.

Existing developments have been extremely popular with wealthy Thai investors, which bodes very well for the industry in Thailand in general, and in Phuket in particular.

With 49% of any condominium development available freehold to foreigners – and Thai investors already eager to invest in the other 51% of branded residences – the Luxury Condominium sector will likely be developing more of this hybrid hotel/condo investment in Phuket.

The first branded residence in Thailand followed shortly thereafter with the Amanpuri in Phuket, which revolutionised the concept with its resort setting.

In the last 30 years, the sector has gone from strength to strength. Today there are over 70 hotel groups which have entered the sector.

It is not a coincidence that the decade which saw the creation of branded residences (the 1920s), and the periods which saw an expansion in the market for luxury hotel-branded accommodation (the 1980s and present day), were all times of significant wealth creation.

According to Credit Suisse’s Global Wealth Report 2018, there are 42.2 million millionaires in the world, while Forbes magazine places the number of billionaires at 2,153. And in the last decade, the numbers of millionaires and billionaires in the world have more than doubled.

This shifting demographic is good news for Branded Residences, as their prices tend to be a few notches above traditional condominiums. But for that money, buyers know they can expect exquisite designs, often from world-renowned architects, as well as luxury interiors with the highest quality fixtures. In Phuket, they can also expect resort settings with magnificent landscaping, and wonderful views.

The quality standards that accompany a luxury hotel name not only ensure that the units sell for premium prices, but also that they are in high demand as rental properties, and command premium rental prices.

Existing developments have been extremely popular with wealthy Thai investors, which bodes very well for the industry in Thailand in general, and in Phuket in particular.

With 49% of any condominium development available freehold to foreigners – and Thai investors already eager to invest in the other 51% of branded residences – the Luxury Condominium sector will likely be developing more of this hybrid hotel/condo investment in Phuket.

Social Contact