Cryptocurrency and Phuket Property – The Current Reality

The idea of using cryptocurrency in Phuket property transactions in Phuket is no longer as far-fetched as it once seemed. By 2025, digital assets such as Bitcoin and Ethereum are increasingly discussed as alternative ways of transferring value, particularly by international clients who follow global financial trends.

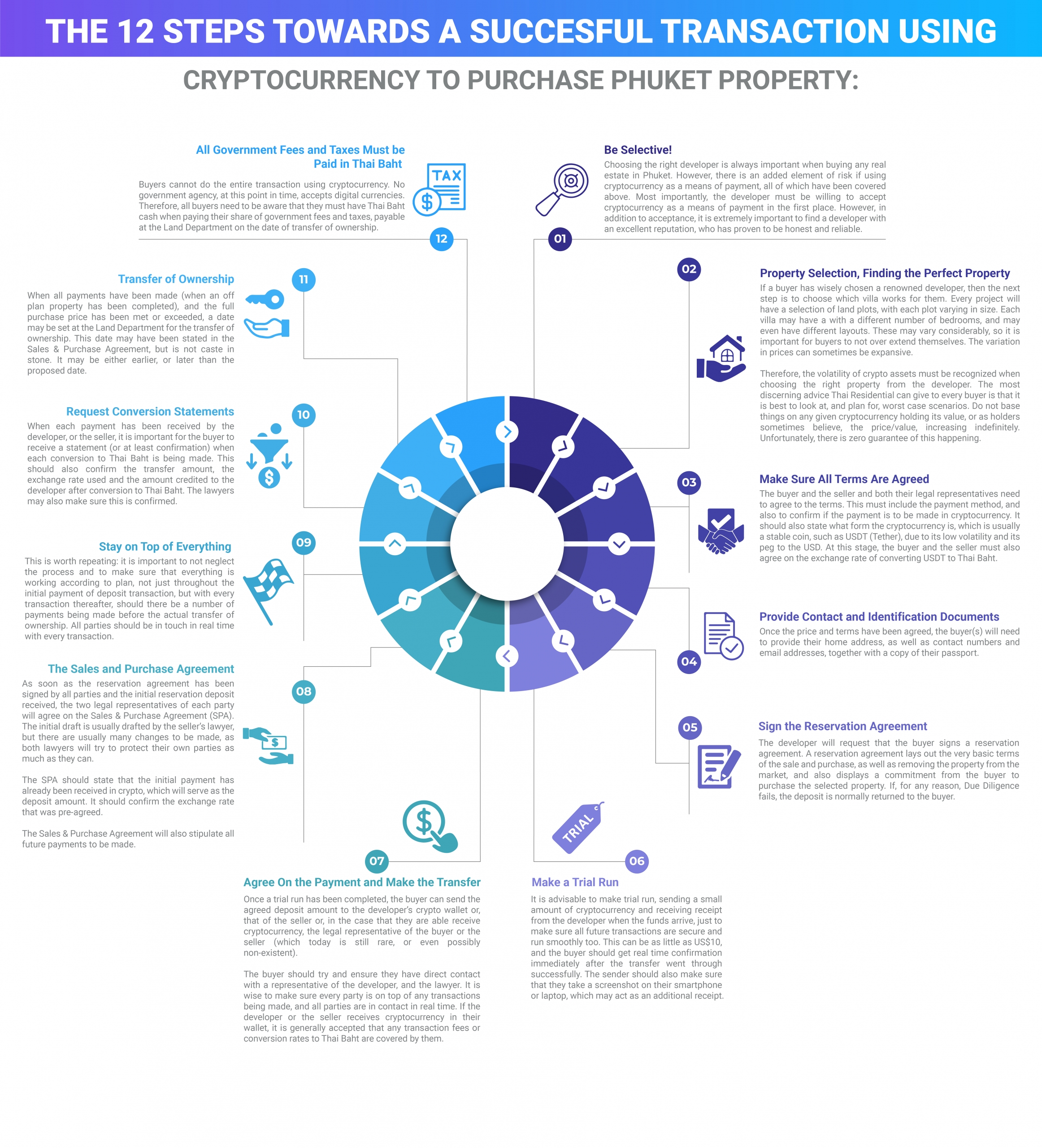

While the concept of cryptocurrency in Phuket property generates a lot of questions from foreigners (and some local residents), it’s important to remember that all official property transfers in Thailand must still be completed in Thai Baht. This means crypto can play a role privately between parties, but the legal side of the transaction still depends on national legislation.

Globally, countries have taken different stances on digital assets. In some jurisdictions, crypto transactions remain restricted or outright illegal. Thailand, however, has been relatively open to digital technology, digital payments, and blockchain. The authorities have granted licences to crypto exchanges and issued a Royal Decree on Digital Asset Business back in 2018, making it clear that the sector is recognised and regulated.

Can Cryptocurrency Be Used in Phuket Property Transactions?

Yes, but not directly. Crypto must be converted into Thai Baht through approved channels, and the transaction must still comply with all Thai property laws.

Developers or private sellers who are open to receiving digital assets may treat cryptocurrency in Phuket property transactions as a form of settlement at an agreed exchange rate, but the Land Department will only register ownership once the funds appear in baht.

Where It Works – and Where It Doesn’t

-

Foreign Freehold Condominiums

Current condominium laws require that purchase funds are transferred into Thailand in foreign currency, and a Foreign Exchange Transaction Form (FETF) is issued by a Thai bank. This document must be presented at the Land Department during transfer of ownership. Because crypto cannot generate an FETF, it is not possible to use digital assets directly for a foreign freehold condo purchase. Buyers must convert crypto into fiat currency abroad before remitting funds into Thailand. -

Leasehold Condos and Apartments

Leasehold purchases fall outside the FETF requirement. While not every developer accepts digital assets, in principle, a leasehold agreement can be settled using crypto if both parties agree. -

Villas

Foreigners commonly structure villa ownership by leasing the land and owning the building, or by setting up a Thai Company to hold the land. If the arrangement is leasehold-based, crypto may be used for the lease payment if the developer or seller accepts it. However, other elements, such as land registration or future fund repatriation, must still flow through normal banking channels for compliance. -

Secured or Protected Leaseholds

In cases where a share transfer occurs offshore, digital assets may be used as part of settlement if buyer and seller agree, as this happens outside Thailand’s regulatory framework. -

Thai Company Ownership

Foreigners cannot own land directly, but may establish a Thai Company (with proper Thai shareholders) that is legally allowed to hold land. Under Thai law, paid-up/registered capital must appear on the company’s balance sheet, and cryptocurrencies cannot be used as paid-up capital. Any digital currency would have to be converted to Thai Baht before incorporation.

Key Takeaway

Cryptocurrency can feature in private arrangements or as part of settlement, but official property transfers in Phuket, especially freehold condo registrations, still require baht and bank-issued documentation. Leaseholds and certain private agreements allow more flexibility, but the safest approach is always to seek legal guidance and confirm the method of settlement with the parties involved.

Thai Companies and Cryptocurrency

Foreigners cannot own land directly in Thailand. While a properly structured Thai Company (with genuine Thai shareholders and compliance under corporate law) is legally permitted to hold land, this remains a highly regulated area. Thai authorities scrutinise such arrangements closely, and many company structures set up for the purpose of land ownership may not withstand legal review if challenged.

When it comes to cryptocurrency, there is an additional barrier. The paid-up capital of a Thai Company must be recorded on its balance sheet, and under current law, digital assets cannot be used as paid-up capital. Any cryptocurrency intended for this purpose must first be converted into Thai Baht before being applied to company formation.

Understanding the Risks of Using Cryptocurrency in Phuket Property Transactions

Like all financial tools, digital assets carry risks. Anyone considering the use of cryptocurrency in Phuket property transactions should be aware of the challenges that may arise.

1. Volatility

Cryptocurrencies are known for sharp price swings. For example, Bitcoin lost nearly 50% of its value in just two days back in March 2020. If the value of digital assets drops suddenly during a transaction, it could create difficulties in meeting agreed terms or completing the settlement.

2. Anti-Money Laundering (AML) Requirements

While early adopters were drawn to the anonymity of crypto, regulators worldwide have tightened oversight. Transactions are now subject to stricter AML controls. Anyone using crypto in a financial transaction should ensure compliance to avoid potential loss of funds or legal consequences.

3. Constantly Changing Legislation

Governments continue to revise their policies on digital assets, digital payments, and AML procedures. These shifts can impact how transactions are conducted. Wallet providers and exchanges must stay aligned with regulations, and participants should remain aware that rules may evolve quickly.

4. Additional Fees

Currency conversion costs, exchange fees, or administrative charges may apply if digital assets are converted into fiat currency for settlement. Depending on the agreement, additional charges could arise during the process.

5. Taxation

Tax treatment of cryptocurrency varies worldwide. Some jurisdictions classify digital assets as “property” and levy taxes accordingly. As regulations tighten, individuals should be aware of potential tax obligations linked to digital asset transfers.

In Summary

For anyone curious about cryptocurrency in Phuket property, the most important step is understanding the legal framework. Official transactions at the Land Office must still be completed in Thai Baht, and compliance with AML procedures is essential. Converting digital assets into baht through approved exchanges remains the safest path, and careful documentation ensures smoother dealings in the future.

Cryptocurrency may feature in private arrangements or leasehold settlements, but as with all financial matters in Thailand, regulations are evolving. Staying informed and seeking professional legal guidance is the best way to avoid unnecessary complications.

Related Guides

Disclaimer: The information contained in this article is provided for general informational purposes only and does not constitute legal, financial, or investment advice. While every effort has been made to ensure accuracy at the time of publication, property laws and regulations in Thailand are subject to change. Readers should always seek independent legal advice from a qualified Thai lawyer before making any property-related decision or transaction.

Social Contact